BASF share performance

- Stock markets fluctuate widely over course of year

- BASF share gains 1.2% in 2015

- Ten-year development continues to clearly outperform benchmark indexes

The weak euro and the European Central Bank’s (ECB) announced intention to purchase large amounts of additional bonds both provided the stock markets with a positive start to 2015. On April 10, 2015, new record highs were achieved as the German benchmark index DAX 30 closed at 12,375 points and the BASF share price at €96.72. As the second quarter progressed, concerns – especially about Greece’s financial solvency – led to share price losses. The second half of the year saw the market rebound as European finance ministers approved the third bailout package for Greece and the eurozone produced robust economic figures. This was followed by considerable dips, due in large part to the weak economic situation in China and severe recession in Brazil. The further depreciation of the euro, positive economic development and speculation as to a renewed expansion of the ECB’s monetary policy initially led to a fourth-quarter boost in share prices, including the BASF share. Prices dropped again in December, however, after the ECB announced intentions to continue easing its monetary policy, a decision that disappointed many investors who had anticipated more expansive measures.

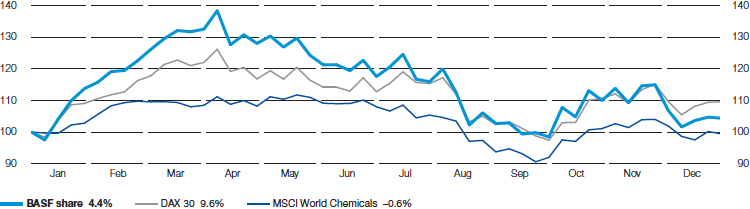

Change in value of an investment in BASF shares in 2015

(With dividends reinvested; indexed)

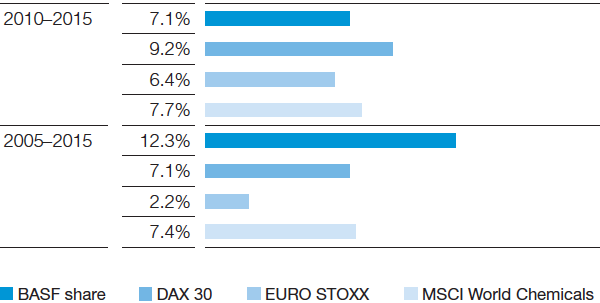

BASF shares traded at €70.72 at the end of 2015, 1.2% above the previous year’s closing price. Assuming that dividends were reinvested, BASF shares gained 4.4% in value in 2015. This did not match the performance of the German and European stock markets, whose benchmark indexes DAX 30 and DJ EURO STOXX 50 gained 9.6% and 6.4% over the same period, respectively. As for the global industry indexes, DJ Chemicals fell by 3.3% in 2015 while MSCI World Chemicals declined by 0.6%. Viewed over a ten-year period, the long-term performance of BASF shares still clearly outperforms these indexes. The assets of an investor who invested €1,000 in BASF shares at the end of 2005 and reinvested the dividends in additional BASF shares would have increased to €3,195 by the end of 2015. This represents a yield of 12.3% each year, placing BASF shares above the returns for the DAX 30 (7.1%), EURO STOXX 50 (2.2%) and MSCI World Chemicals (7.4%) indexes.

Long-term performance of BASF shares compared with indexes

(Average annual increase with dividends reinvested)

Weighting of BASF shares in important indexes as of December 31, 2015 |

||

DAX 30 |

|

7.4% |

|---|---|---|

DJ Chemicals |

|

5.9% |

MSCI World Index |

|

0.2% |

Further information on BASF share |

||

Securities code numbers |

|

|

|---|---|---|

Germany |

|

BASF11 |

Great Britain |

|

0083142 |

Switzerland |

|

323600 |

United States (CUSIP Number) |

|

055262505 |

ISIN International Securities Identification Number |

|

DE000BASF111 |

|

|

|

International ticker symbol |

|

|

Deutsche Börse |

|

BAS |

London Stock Exchange |

|

BFA |

Swiss Exchange |

|

AN |