BASF on the Capital Market

Overview of BASF shares |

||||

|---|---|---|---|---|

|

|

|

3rd Quarter 2015 |

Jan. – Sep. 2015 |

Performance (with dividends reinvested) |

|

|

|

|

BASF |

|

% |

(13.3) |

0.8 |

DAX 30 |

|

% |

(11.7) |

(1.5) |

DJ EURO STOXX 50 |

|

% |

(9.2) |

1.0 |

DJ Chemicals |

|

% |

(15.1) |

(9.9) |

MSCI World Chemicals |

|

% |

(15.9) |

(9.7) |

|

|

|

|

|

Share prices and trading (XETRA) |

|

|

|

|

Average |

|

€ |

75.03 |

81.15 |

High |

|

€ |

85.25 |

96.72 |

Low |

|

€ |

65.74 |

65.74 |

Close (end of period) |

|

€ |

68.32 |

68.32 |

Average daily trade |

|

million shares |

3.4 |

3.4 |

Outstanding shares (end of period) |

|

million shares |

918.5 |

918.5 |

Market capitalization (end of period) |

|

billion € |

62.8 |

62.8 |

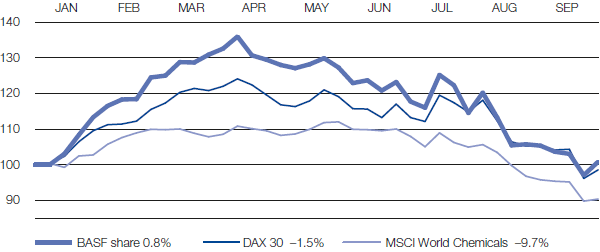

Share performance

- Stock markets volatile, with losses at end of quarter

- BASF share price closes 13.3% below second quarter

The third quarter initially began with recovery on the stock markets as European finance ministers approved the third bailout package for Greece, while the eurozone and United States showed robust economic figures. As the quarter progressed, weak economic data from China and the intensification of the recession in Brazil led to massive share price losses. The Chinese central bank helped stabilize the situation by relaxing the reserve requirement for commercial banks and reducing interest rates; however, the U.S. Federal Reserve’s decision not to raise interest rates for the time being led to uncertainty on the market. As a result, stock markets once again took a dip toward the end of the quarter.

At €68.32, the BASF share traded 13.3% lower than its closing price in the second quarter of 2015, while the German stock index DAX 30 lost 11.7%. The European benchmark index DJ EURO STOXX 50 fell by 9.2% over the same period. The global industry indexes DJ Chemicals and MSCI World Chemicals declined by 15.1% and 15.9%, respectively.

Good credit ratings and solid financing

BASF has good credit ratings, especially in comparison with competitors in the chemical industry. Rating agency Moody’s last confirmed their rating of “A1/P-1 outlook stable” on May 5, 2015. Standard & Poor’s adjusted their rating of “A+/A-1” to an outlook of “negative” on April 10, 2015. This was largely due to an increase in pension provisions as a result of lower capital market interest rates. We continue to have solid financing. Since the beginning of the year, net debt has increased by €98 million to €13.8 billion.

BASF a sustainable investment

In September, BASF shares were included in the Dow Jones Sustainability World Index (DJSI World) for the fifteenth year in succession. This year, analysts particularly praised our commitment to innovation management, environmental and social responsibility reporting, product stewardship and employee development. As one of the most well-known sustainability indexes, the DJSI World represents the top 10% of the 2,500 largest companies in the Dow Jones Global Index based on economic, environmental and social criteria.

Contact our Investor Relations team by phone at +49 621 60-48230 or email ir@basf.com

Change in value of an investment in BASF shares (Jan. – Sep. 2015)

(With dividends reinvested; indexed)