BASF on the Capital Market

|

|

|

|

1st Quarter 2016 |

Full Year 2015 |

|---|---|---|---|---|

|

Performance (with dividends reinvested) |

|

|

|

|

|

BASF |

|

% |

(6.3) |

4.4 |

|

DAX 30 |

|

% |

(7.2) |

9.6 |

|

DJ EURO STOXX 50 |

|

% |

(7.8) |

6.4 |

|

DJ Chemicals |

|

% |

(0.5) |

(3.3) |

|

MSCI World Chemicals |

|

% |

(3.1) |

(0.6) |

|

|

|

|

|

|

|

Share prices and trading (XETRA) |

|

|

|

|

|

Average |

|

€ |

62.46 |

79.28 |

|

High |

|

€ |

70.72 |

96.72 |

|

Low |

|

€ |

56.70 |

65.74 |

|

Close (end of period) |

|

€ |

66.30 |

70.72 |

|

Average daily trade |

|

million shares |

3.8 |

3.3 |

|

Outstanding shares (end of period) |

|

million shares |

918.5 |

918.5 |

|

Market capitalization (end of period) |

|

billion € |

60.9 |

65.0 |

Share performance

- BASF shares follow trend of key European benchmark indexes

In an environment marked by weak economic figures from the United States and China – especially at the beginning of the year – as well as by a turbulent crude oil market, BASF shares closed the first quarter at €66.30, 6.3% below the closing price at the end of 2015. The German stock index DAX 30 and the European benchmark index DJ EURO STOXX 50 both fell over the same period by 7.2% and 7.8%, respectively. The global industry indexes DJ Chemicals and MSCI World Chemicals also weakened in the first three months of the year, declining by 0.5% and 3.1%, respectively.

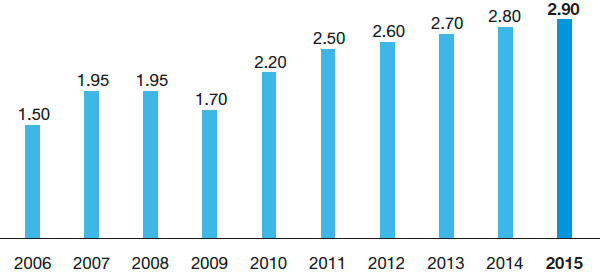

Dividend increase to €2.90 per share

- Payout of around €2.7 billion to BASF’s shareholders

The Board of Executive Directors and the Supervisory Board proposed to the Annual Shareholders’ Meeting that a dividend of €2.90 per share be paid for the 2015 business year. We stand by our ambitious dividend policy and plan to pay out around €2.7 billion to our shareholders. Based on the year-end share price for 2015, BASF shares offer a high dividend yield of 4.1%. BASF is part of the DivDAX share index, which contains the fifteen companies with the highest dividend yield in the DAX 30. We aim to increase our dividend each year, or at least maintain it at the previous year’s level.

Contact our Investor Relations team by phone at +49 621 60-48230 or email ir@basf.com

Good credit ratings and solid financing

BASF has solid financing and good credit ratings, especially in comparison with competitors in the chemical industry. Rating agency Moody’s last confirmed their “A1/P-1 outlook stable” rating on November 4, 2015. Standard & Poor’s adjusted their BASF rating from “A+/A-1 outlook negative” to “A/A-1 outlook stable” on March 14, 2016. This decision was largely based on the weaker market environment, especially for basic and agricultural chemicals; limited overall volumes growth; and the considerable drop in the price of crude oil. Uncertainty with regard to economic development in China was also taken into consideration.

In the first quarter of 2016, we issued a 15-year bond with a €200 million volume and a coupon of 1.5%. We furthermore tapped our 2013-2021 bond with a 1.875% coupon, increasing its volume by €300 million to €1 billion, effective April 5, 2016. With an issue price of over 100%, the tap resulted in an effective annual interest rate of 0.37%.

Since the beginning of the year, net debt fell by €190 million to €12.8 billion.

Dividend per share1 (€ per share)

1 Adjusted for two-for-one stock split conducted in 2008