Functional Materials & Solutions

2nd Quarter 2017

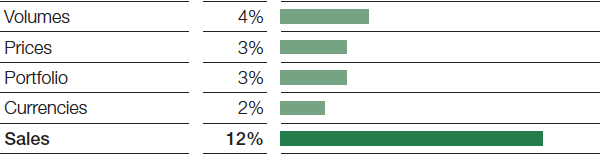

Compared with the same quarter of the previous year, sales grew considerably in the Functional Materials & Solutions segment. This development was largely attributable to an increase in sales volumes, the Chemetall business acquired from Albemarle in December 2016, and higher prices. Currency effects additionally supported sales. We were able to boost our sales volumes to the automotive industry. Income from operations (EBIT) before special items was considerably below the level of the second quarter of 2016. The earnings increase in the Catalysts division and the contribution from the Chemetall business could only partly compensate for overall lower margins and higher fixed costs.

Factors influencing sales, Functional Materials & Solutions

2nd Quarter 2017

Catalysts

Sales in the Catalysts division grew considerably year-on-year as a result of higher volumes and prices. The mobile emissions catalysts, precious metal trading, and chemical catalysts businesses all contributed substantially to the increase in volumes. The higher level of sales prices was mainly a consequence of increased precious metal prices. Currency effects had a positive influence on sales, while the divestiture of the polyolefin catalysts business in 2016 slowed sales growth. In precious metal trading, sales rose to €651 million due to higher prices, increased volumes and positive currency effects (second quarter of 2016: €554 million). EBIT before special items grew considerably, largely on account of the growth in volumes.

Construction Chemicals

In the Construction Chemicals division, sales rose slightly year-on-year owing to the acquisition of Henkel’s western European building material business for professional users at the beginning of 2017. Volumes and prices remained stable. Sales in Europe grew considerably due to the acquisition and to an increase in volumes. In Asia, volumes growth was the main driver behind a considerable increase in sales. With prices stable, lower volumes in North America resulted in a slight decline in sales. Sales fell considerably in the region South America, Africa, Middle East, due primarily to decreased demand in the Middle East as well as to negative currency effects. EBIT before special items was considerably down on account of higher fixed costs and lower margins brought about by rising raw material prices.

Coatings

In the Coatings division, sales grew considerably compared with the previous second quarter mainly as a result of the Chemetall business acquired from Albemarle in December 2016. We raised sales volumes, primarily for automotive OEM coatings, and experienced positive currency effects overall. Sales prices declined slightly. In the automotive OEM coatings business, significantly higher volumes in Asia and North America led to slight growth in sales. Sales of automotive refinish coatings dipped slightly. EBIT before special items was considerably below the previous second-quarter level, largely owing to shrunken margins and the divestiture of the industrial coatings business at the end of 2016. This was contrasted by the earnings contribution from the Chemetall business.

Performance Materials

Sales in the Performance Materials division grew considerably year-on-year, driven predominantly by higher prices and volumes. In Europe and Asia, we raised sales prices in response to the sharp increase in raw material prices. Slight volumes growth was primarily supported by our business with thermoplastic polyurethanes and engineering plastics. Demand from the consumer goods sector increased substantially while volumes to the construction and automotive industries rose slightly. Currency effects had a positive influence on sales. EBIT before special items was considerably below the second quarter of 2016, largely owing to lower margins caused by higher raw material prices.

|

|

2nd Quarter |

1st Half |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

2017 |

2016 |

Change % |

2017 |

2016 |

Change % |

||||

|

|||||||||||

Sales to third parties |

|

5,261 |

4,703 |

12 |

10,459 |

9,111 |

15 |

||||

Thereof Catalysts |

|

1,674 |

1,508 |

11 |

3,363 |

2,975 |

13 |

||||

Construction Chemicals |

|

646 |

629 |

3 |

1,206 |

1,162 |

4 |

||||

Coatings |

|

998 |

800 |

25 |

1,997 |

1,538 |

30 |

||||

Performance Materials |

|

1,943 |

1,766 |

10 |

3,893 |

3,436 |

13 |

||||

Income from operations before depreciation and amortization (EBITDA) |

|

584 |

756 |

(23) |

1,272 |

1,350 |

(6) |

||||

Amortization and depreciation1 |

|

157 |

225 |

(30) |

324 |

367 |

(12) |

||||

Income from operations (EBIT) |

|

427 |

531 |

(20) |

948 |

983 |

(4) |

||||

Special items |

|

5 |

(4) |

. |

(5) |

(8) |

38 |

||||

EBIT before special items |

|

422 |

535 |

(21) |

953 |

991 |

(4) |

||||

Assets (June 30) |

|

17,334 |

13,671 |

27 |

17,334 |

13,671 |

27 |

||||

Investments including acquisitions2 |

|

194 |

132 |

47 |

357 |

262 |

36 |

||||

Research and development expenses |

|

110 |

95 |

16 |

209 |

191 |

9 |

||||