BASF Group Business Review 1st Quarter 2016

Both sales and earnings in the first quarter of 2016 reflected the lack of contributions to the Oil & Gas segment from the natural gas trading and storage business resulting from the asset swap completed with Gazprom at the end of September 2015. With volumes stable, business development was further weighed down by lower prices in connection with the price of oil. As a consequence, our sales fell considerably, and we posted a slight decrease in income from operations before special items.1 The Performance Products, Functional Materials & Solutions and Agricultural Solutions segments were able to slightly raise their earnings.

Sales and income from operations before special items

- Sales decline by 29% to €14.2 billion

- EBIT before special items down by 8% to €1.9 billion

Compared with the first quarter of 2015, our sales decreased by 29% to €14.2 billion. This was largely on account of the divestiture of the gas trading and storage business, which had contributed €4.2 billion to sales in the first quarter of 2015. In addition, the lower price of oil led to declining sales prices in the Chemicals segment in particular as well as in our other chemicals business2, and in the Oil & Gas segment.

The significantly smaller contributions from the Oil & Gas and Chemicals segments reduced income from operations before special items by €164 million to €1.9 billion. We were able to slightly raise income from operations before special items in the Performance Products, Functional Materials & Solutions and Agricultural Solutions segments. A considerable earnings improvement in Other was especially the result of valuation effects for the long-term incentive program.

1 With reference to sales, “slight” represents a change of 1–5%, while “considerable” applies to changes of 6% and higher. “At prior-year level” indicates no change (+/–0%). For earnings, “slight” means a change of 1–10%, while “considerable” is used for changes of 11% and higher. “At prior-year level” indicates no change (+/–0 %).

2 Our chemicals business comprises the Chemicals, Performance Products and Functional Materials & Solutions segments.

|

|

1st Quarter |

|---|---|---|

Volumes |

|

0 |

Prices |

|

(6) |

Portfolio |

|

(22) |

Currencies |

|

(1) |

|

|

(29) |

Overall sales volumes matched the level of the previous first quarter. We were able to slightly raise volumes in the Functional Materials & Solutions, Oil & Gas and Performance Products segments, whereas they decreased slightly in the Agricultural Solutions and Chemicals segments. The lower price of oil led to declining prices, especially in the Chemicals segment. Portfolio measures mainly comprised the divestiture of the natural gas trading and storage business. Currency effects were slightly negative overall.

Sales and income from operations before special items in the segments

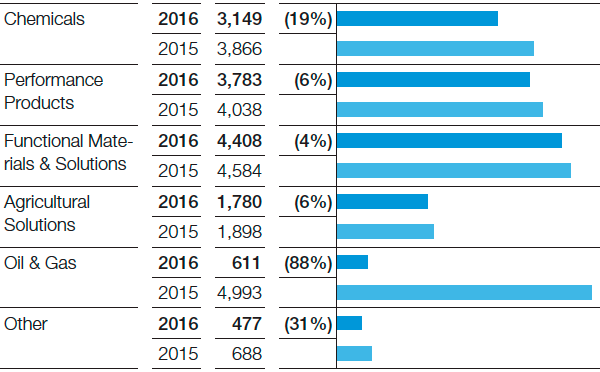

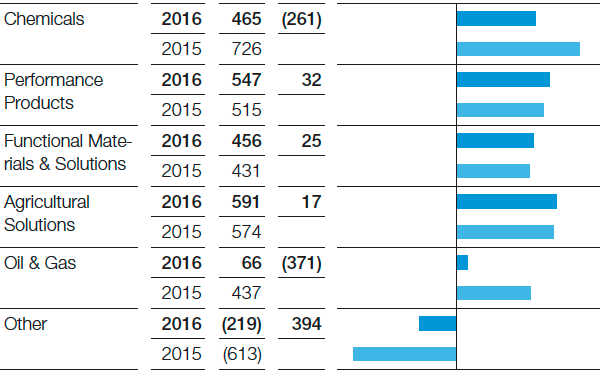

Sales fell considerably in the Chemicals segment, predominantly as a result of price drops brought about by the decline in raw material prices. Sales volumes decreased particularly in the Petrochemicals division in North America. Income from operations before special items was considerably down compared with the first quarter of 2015, which had been marked by high margins. In addition to lower margins, this reduction was also attributable to increased fixed costs arising mainly from the startup of new plants in 2015.

First-quarter sales (million €, relative change)

Despite higher volumes, sales in the Performance Products segment were considerably below the level of the previous first quarter, largely on account of lower sales prices. The main factor here was the oil-price-related decline in raw material costs, although ongoing pressure on prices in the hygiene business was additionally responsible. Thanks to reduced fixed costs and higher volumes, we were able to slightly raise income from operations before special items.

Sales in the Functional Materials & Solutions segment declined slightly, mainly due to falling sales prices as a particular result of lower prices in precious metal trading. Our sales

volumes increased to the automotive and construction industries, driven primarily by higher demand. Thanks to improved contributions from the Performance Materials and Construction Chemicals divisions, income from operations before special items grew slightly.

In a market environment that remains difficult, we posted a considerable year-on-year sales decline in the Agricultural Solutions segment. Price increases were unable to compensate for lower sales volumes and negative currency effects. Income from operations before special items improved slightly. Our margins rose, partly as a result of higher prices, and fixed costs were reduced.

First-quarter EBIT before special items (million €, absolute change)

Sales fell considerably in the Oil & Gas segment. The asset swap completed with Gazprom in 2015 meant a lack of contributions from the natural gas trading and storage business in particular. Sales were additionally weighed down by the decline in oil and gas prices. We were able to ramp up our production volumes, especially in Norway. Income from operations before special items declined considerably, predominantly on account of lower prices as well as the discontinued contributions from the gas trading and storage business.

In Other, sales were considerably down compared with the previous first quarter. Lower prices and volumes in the raw materials trading business were largely responsible, along with the expiration of supply contracts at the end of 2015 in connection with the disposal of our share in the Ellba Eastern Private Ltd. joint operation in Singapore at the end of 2014. Income from operations before special items improved considerably, especially through valuation effects from the longterm incentive program. The increase was also supported by a positive currency result.

Income from operations and special items

Special items in EBIT totaled minus €40 million in the first quarter of 2016, compared with minus €75 million in the first quarter of 2015. These particularly contained special charges from restructuring measures. The previous first quarter had included expenses for the employee bonus paid on the occasion of BASF’s 150th anniversary.

Compared with the previous first quarter, EBIT declined by €129 million to €1,866 million. EBITDA fell by €78 million to €2,812 million.

|

|

2016 |

2015 |

|---|---|---|---|

1st quarter |

|

(40) |

(75) |

2nd quarter |

|

|

8 |

3rd quarter |

|

|

286 |

4th quarter |

|

|

(687) |

Full year |

|

|

(468) |

Financial result and net income

At minus €188 million, the financial result was below the level of the first quarter of 2015 (minus €164 million), largely owing to the reduced other financial result. The lower level of income from shareholdings was offset by a better interest result.

Income before taxes and minority interests fell by €153 million to €1,678 million. The tax rate was 15.4% (first quarter of 2015: 29.7%), a drop that was mainly attributable to lower deferred taxes in the Oil & Gas segment.

Net income rose by €213 million to €1,387 million.

Earnings per share were €1.51 in the first quarter of 2016, compared with €1.28 in the same period of 2015. Adjusted for special items and amortization of intangible assets, earnings per share amounted to €1.64 (first quarter of 2015: €1.43).

|

|

2016 |

2015 |

|---|---|---|---|

1st quarter |

|

1.64 |

1.43 |

2nd quarter |

|

|

1.49 |

3rd quarter |

|

|

1.07 |

4th quarter |

|

|

1.01 |

Full year |

|

|

5.00 |