Chart Gallery

-

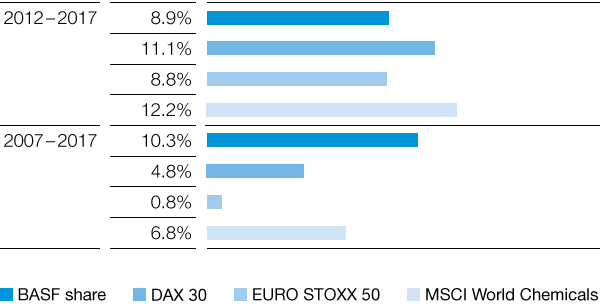

Long-term performance of BASF shares compared with indexes (Average annual increase with dividends reinvested)

Go to corresponding page

-

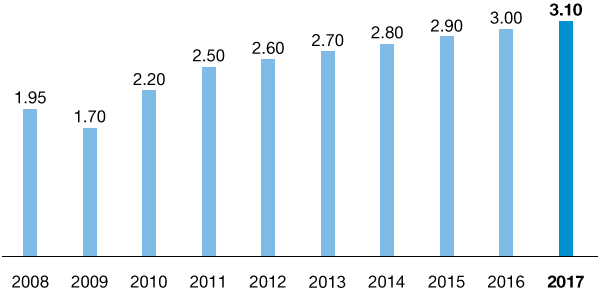

Dividend per share (€ per share)

Go to corresponding page

-

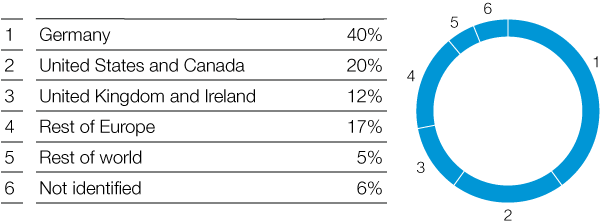

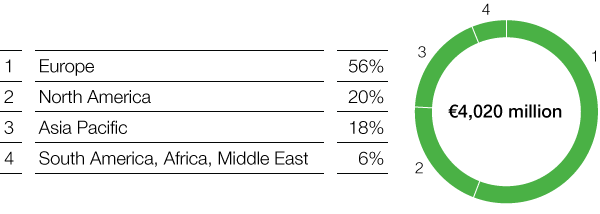

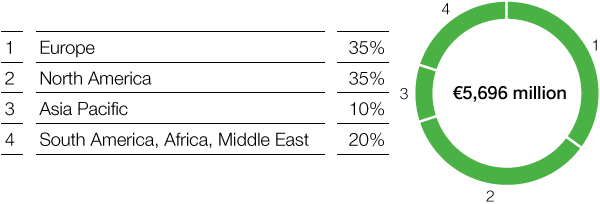

Shareholder structure (by region, rounded)

Go to corresponding page

-

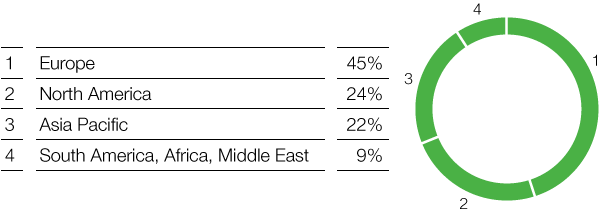

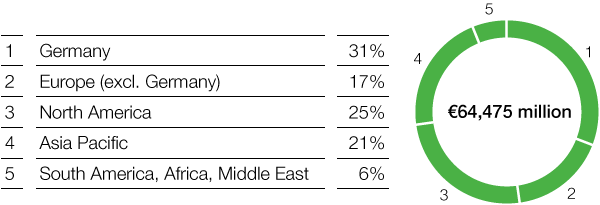

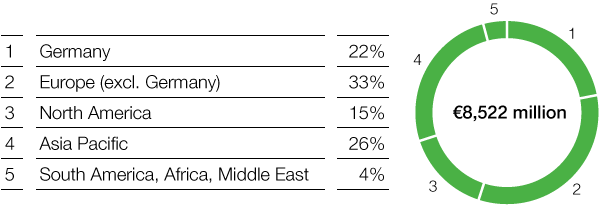

Procurement and sales markets

Go to corresponding page

-

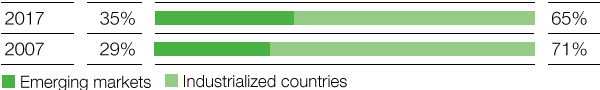

Sales3 in emerging markets

3 Percentage of BASF Group sales (excluding Oil & Gas) by location of customer Go to corresponding page

-

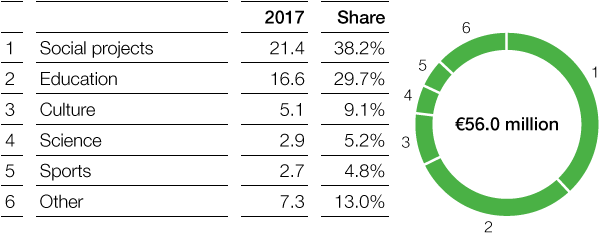

BASF Group donations, sponsorship and own projects in 2017 (million €)

Go to corresponding page

-

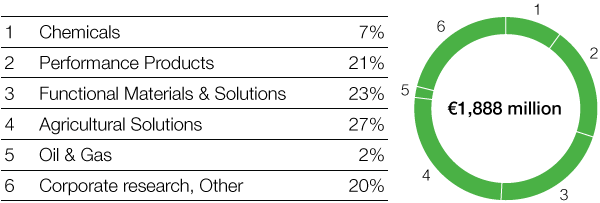

Research and development expenses by segment 2017

Go to corresponding page

-

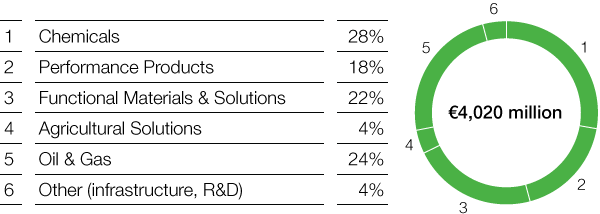

Additions to property, plant and equipment4 by segment in 2017

Go to corresponding page

-

Additions to property, plant and equipment4 by region in 2017

Go to corresponding page

-

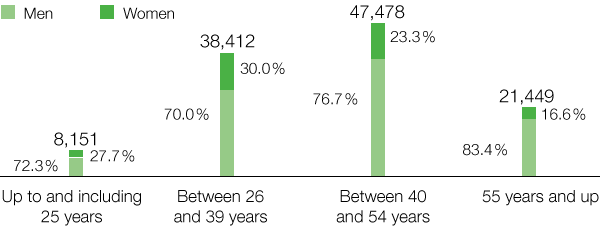

BASF Group employee age structure (Total: 115,490 thereof 24.6% women, as of December 31, 2017)

Go to corresponding page

-

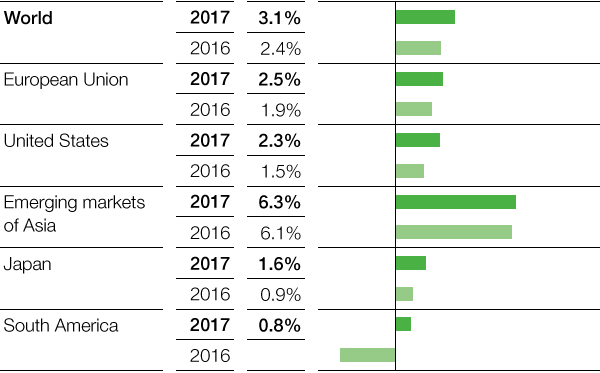

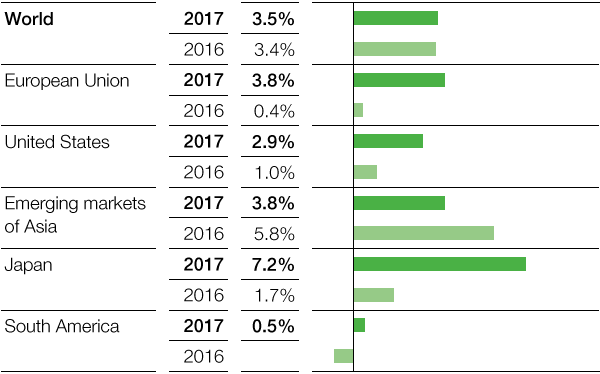

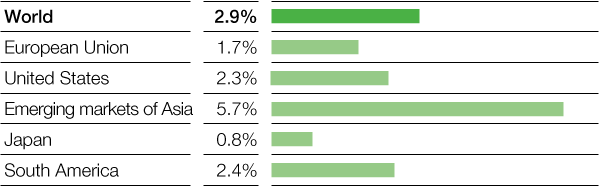

Gross domestic product (Real change compared with previous year 1)

1 Figures that refer to previous years may deviate from last year’s report due to statistical revisions. Go to corresponding page

-

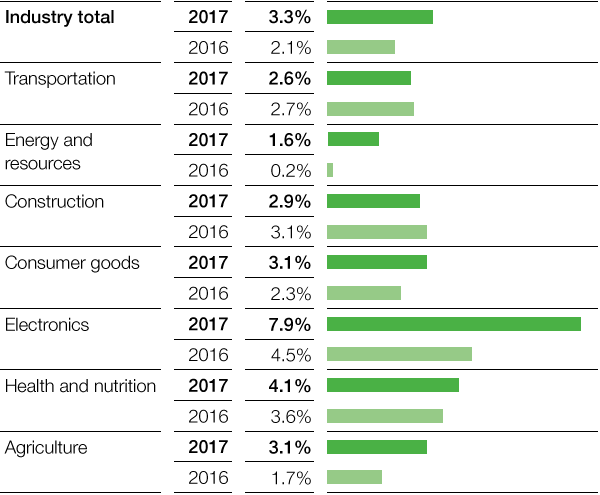

Growth in key customer industries (Real change compared with previous year 1)

1 Figures that refer to previous years may deviate from last year’s report due to statistical revisions. Go to corresponding page

-

Chemical production (excluding pharmaceuticals) (Real change compared with previous year 1)

1 Figures that refer to previous years may deviate from last year’s report due to statistical revisions. Go to corresponding page

-

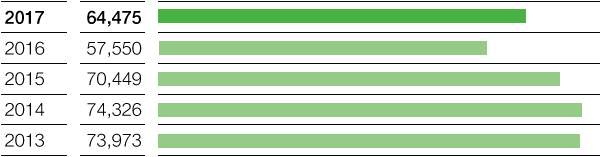

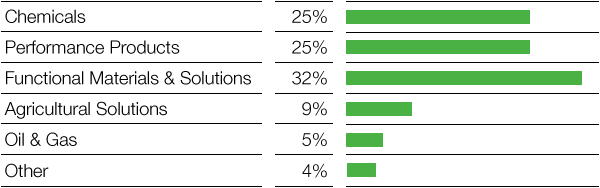

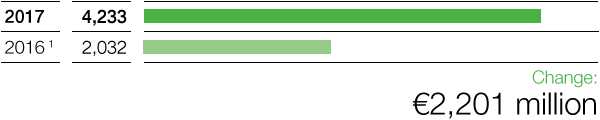

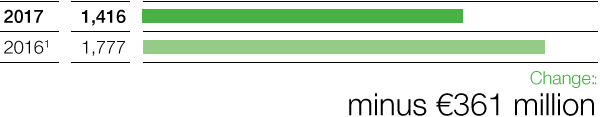

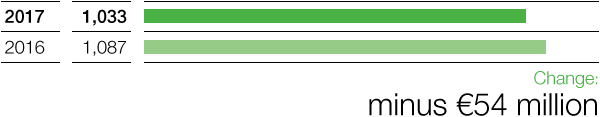

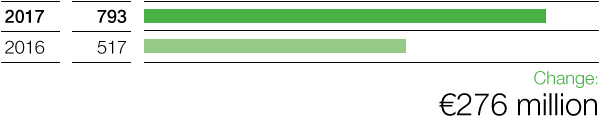

Sales (million €)

Go to corresponding page

-

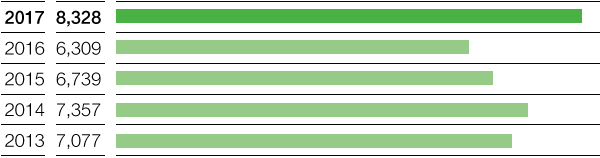

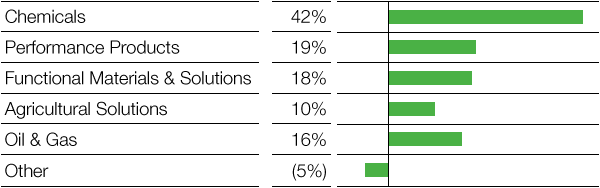

EBIT before special items (million €)

Go to corresponding page

-

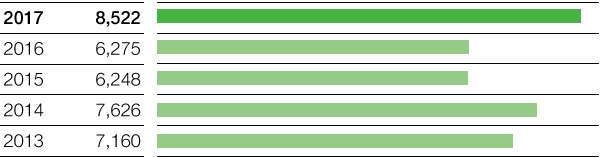

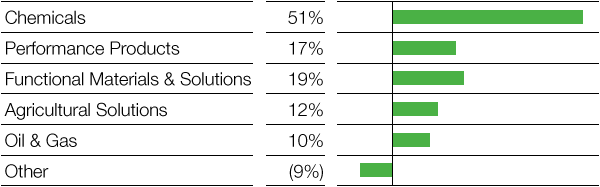

EBIT (million €)

Go to corresponding page

-

EBIT after cost of capital (million €)

Go to corresponding page

-

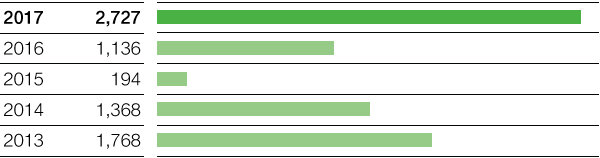

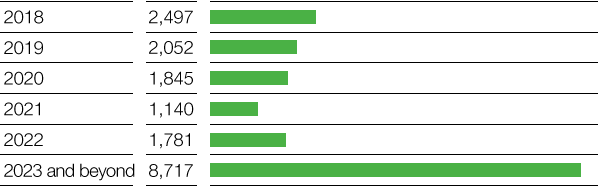

Maturities of financial indebtedness (million €)

Go to corresponding page

-

Financing instruments (million €)

Go to corresponding page

-

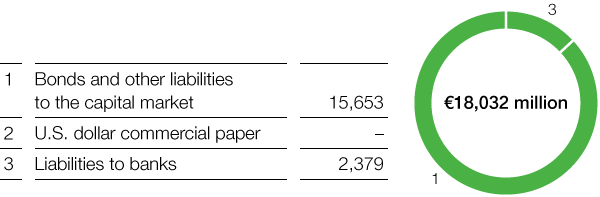

Cash flow (billion €)

1 Including investments to the extent that they already had an effect on cash Go to corresponding page

-

Development by quarter

Go to corresponding page

-

Development by quarter

Go to corresponding page

-

Development by quarter

Go to corresponding page

-

Development by quarter

Go to corresponding page

-

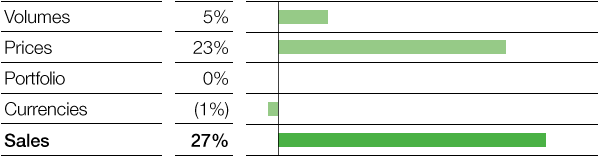

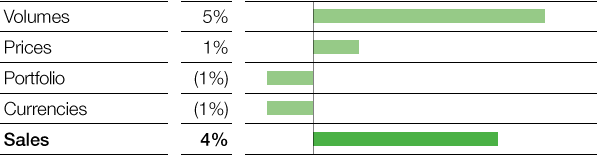

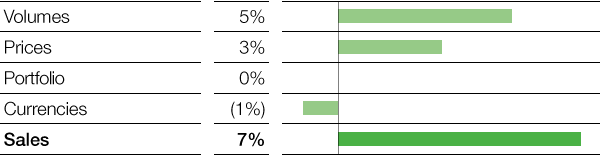

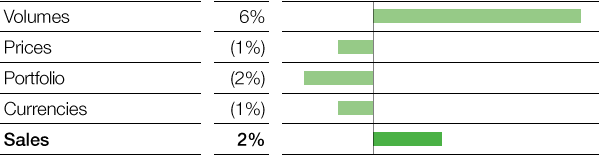

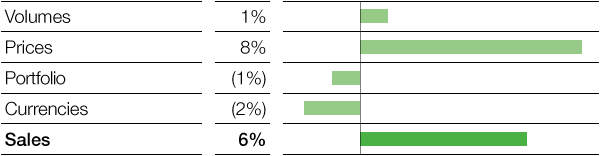

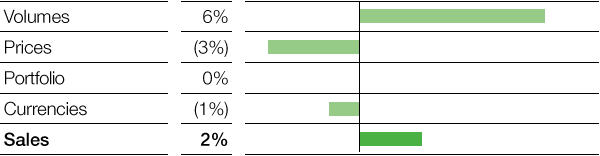

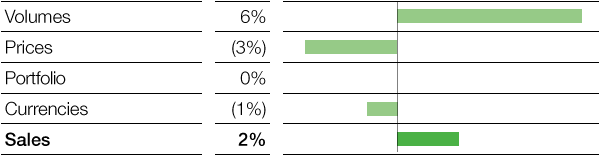

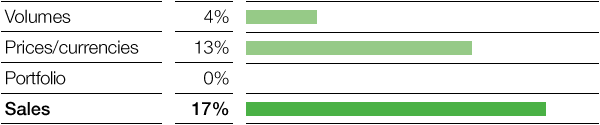

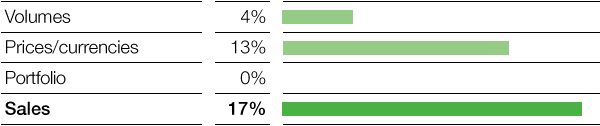

Factors influencing sales

Go to corresponding page

-

Income from operations before special items (million €)

Go to corresponding page

-

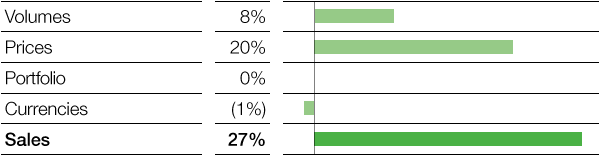

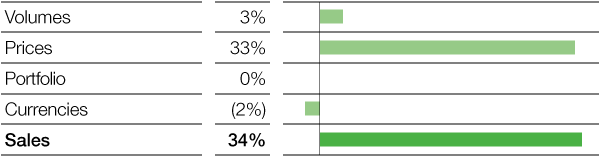

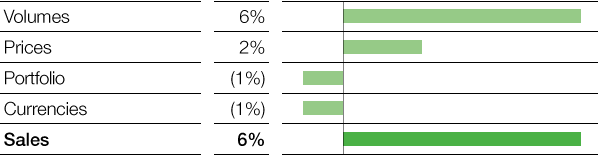

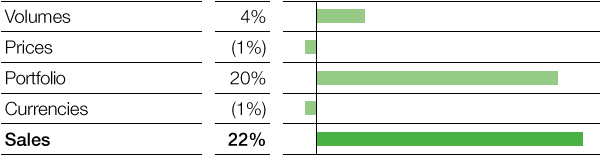

Petrochemicals – Factors influencing sales

Go to corresponding page

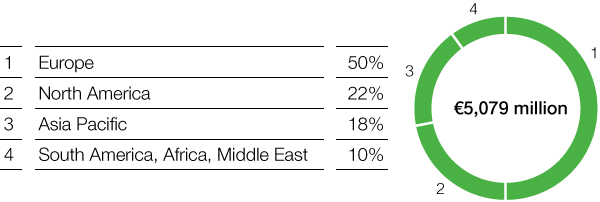

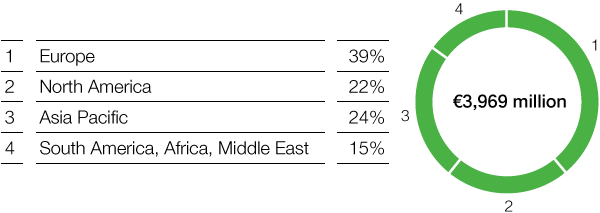

-

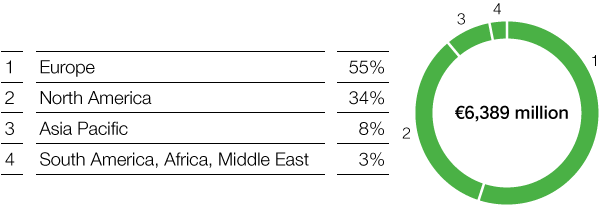

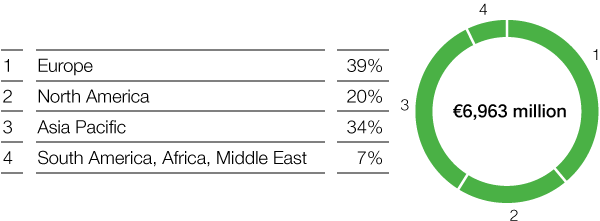

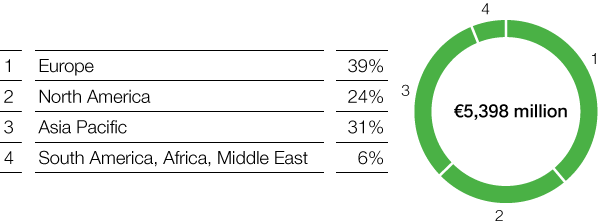

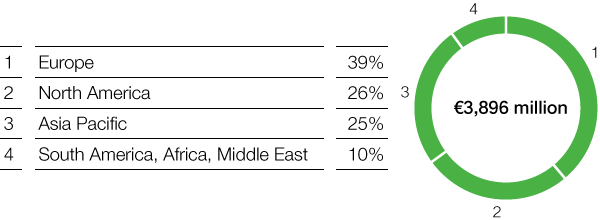

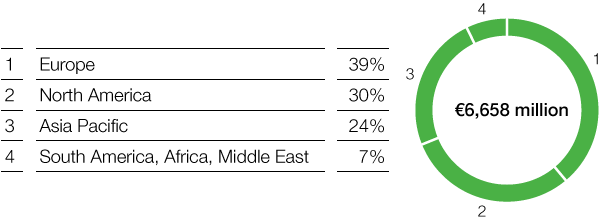

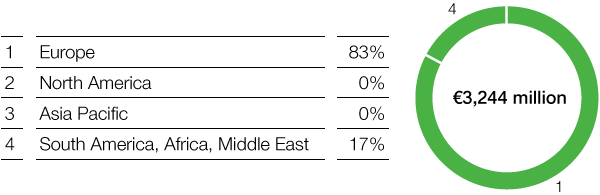

Petrochemicals – Sales by region (Location of customer)

Go to corresponding page

-

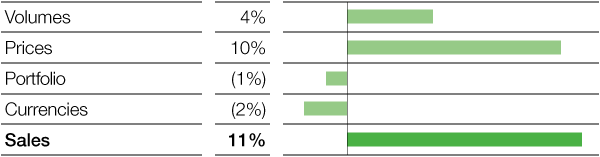

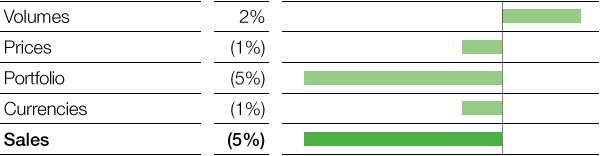

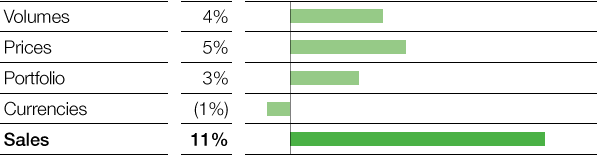

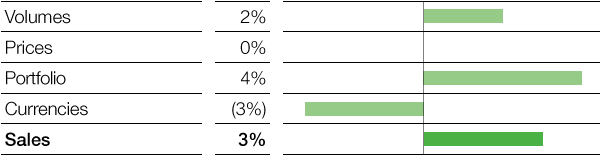

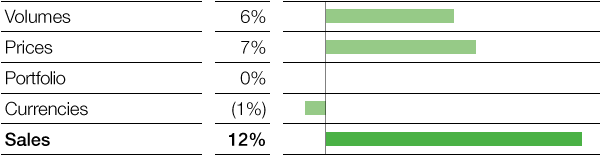

Monomers – Factors influencing sales

Go to corresponding page

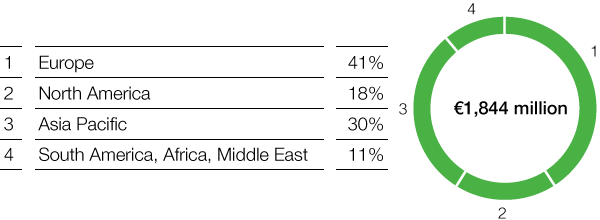

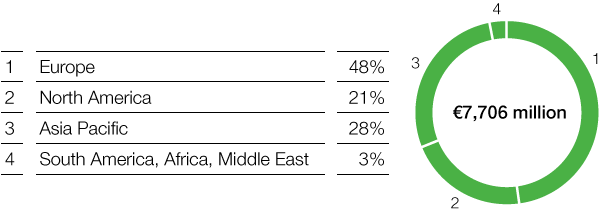

-

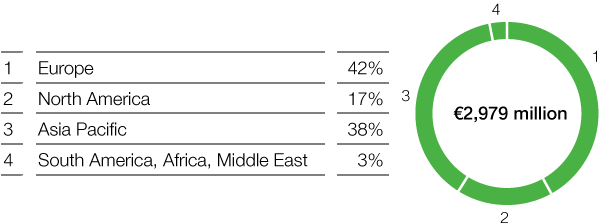

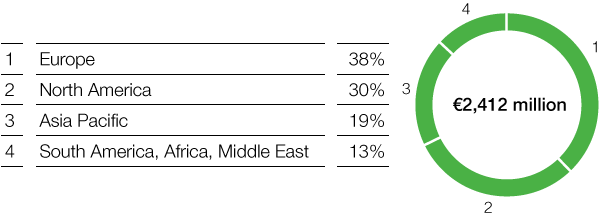

Monomers – Sales by region (Location of customer)

Go to corresponding page

-

Intermediates – Factors influencing sales

Go to corresponding page

-

Intermediates – Sales by region (Location of customer)

Go to corresponding page

-

Factors influencing sales

Go to corresponding page

-

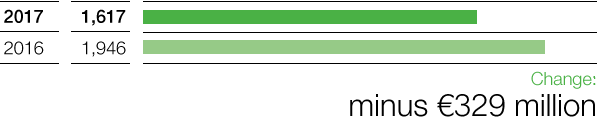

Income from operations before special items (million €)

Go to corresponding page

-

Dispersions & Pigments – Factors influencing sales

Go to corresponding page

-

Dispersions & Pigments – Sales by region (Location of customer)

Go to corresponding page

-

Care Chemicals – Factors influencing sales

Go to corresponding page

-

Care Chemicals – Sales by region (Location of customer)

Go to corresponding page

-

Nutrition & Health – Factors influencing sales

Go to corresponding page

-

Nutrition & Health – Sales by region (Location of customer)

Go to corresponding page

-

Performance Chemicals – Factors influencing sales

Go to corresponding page

-

Performance Chemicals – Sales by region (Location of customer)

Go to corresponding page

-

Factors influencing sales

Go to corresponding page

-

Income from operations before special items (million €)

Go to corresponding page

-

Catalysts – Factors influencing sales

Go to corresponding page

-

Catalysts – Sales by region (Location of customer)

Go to corresponding page

-

Construction Chemicals – Factors influencing sales

Go to corresponding page

-

Construction Chemicals – Sales by region (Location of customer)

Go to corresponding page

-

Coatings – Factors influencing sales

Go to corresponding page

-

Coatings – Sales by region (Location of customer)

Go to corresponding page

-

Performance Materials – Factors influencing sales

Go to corresponding page

-

Performance Materials – Sales by region (Location of customer)

Go to corresponding page

-

Factors influencing sales

Go to corresponding page

-

Income from operations before special items (million €)

Go to corresponding page

-

Agricultural Solutions – Factors influencing sales

Go to corresponding page

-

Agricultural Solutions – Sales by region (Location of customer)

Go to corresponding page

-

Factors influencing sales

Go to corresponding page

-

Income from operations before special items (million €)

Go to corresponding page

-

Oil & Gas – Factors influencing sales

Go to corresponding page

-

Oil & Gas – Sales by region (Location of customer)

Go to corresponding page

-

Sales by region (Location of company)

Go to corresponding page

-

Income from operations by region (Location of company)

Go to corresponding page

-

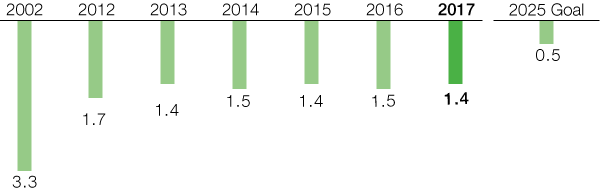

Lost-time injury rate per one million working hours

Go to corresponding page

-

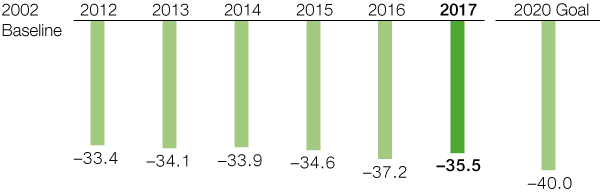

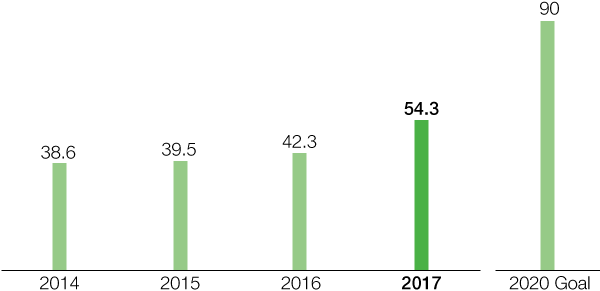

Reduction of greenhouse gas emissions per metric ton of sales product in BASF operations excluding Oil & Gas 1 (%)

1 The value for the 2012 business year was not adjusted to reflect the currently applied global warming potential factors. For more information on our data collection methods, see below. Go to corresponding page

-

Energy supply and efficiency

Go to corresponding page

-

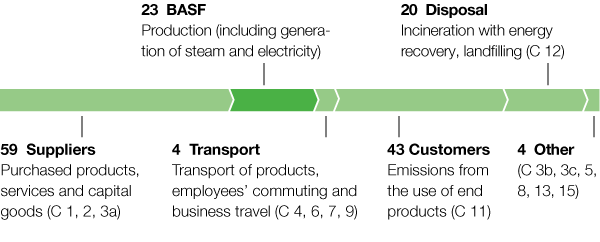

Greenhouse gas emissions along the BASF value chain in 2017 4 (million metric tons of CO2 equivalents)

4 According to Greenhouse Gas Protocol, Scope 1, 2 and 3; categories within Scope 3 are shown in parentheses Go to corresponding page

-

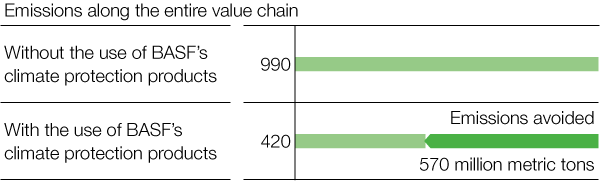

Prevention of greenhouse gas emissions through the use of BASF products (million metric tons of CO2 equivalents)

Go to corresponding page

-

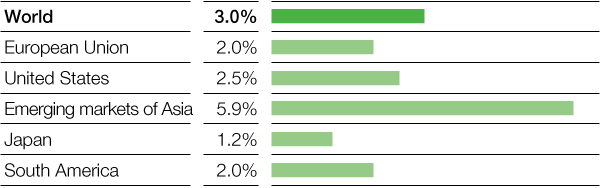

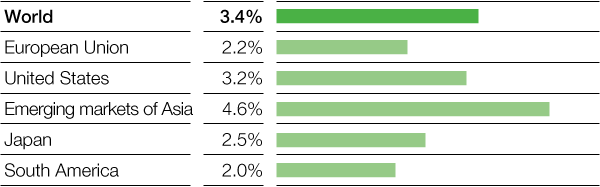

Outlook for gross domestic product 2018 (Real change compared with previous year)

Go to corresponding page

-

Trends in gross domestic product 2018–2020 (Average annual real change)

Go to corresponding page

-

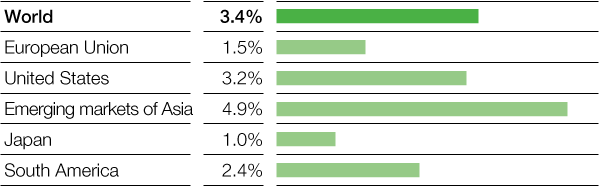

Outlook for chemical production 2018 (excl. pharmaceuticals) (Real change compared with previous year)

Go to corresponding page

-

Trends in chemical production 2018–2020 (excl. pharmaceuticals) (Average annual real change)

Go to corresponding page

-

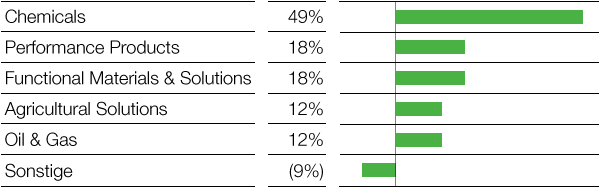

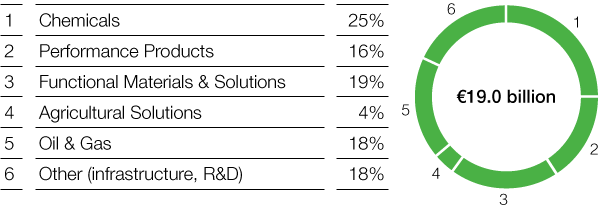

Investments in property, plant and equipment by segment, 2018–2022

Go to corresponding page

-

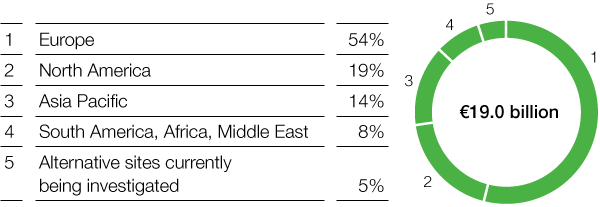

Investments in property, plant and equipment by region, 2018–2022

Go to corresponding page

-

[gri_standards_en_gr.png]Go to corresponding page