Agricultural Solutions

1st Quarter 2017

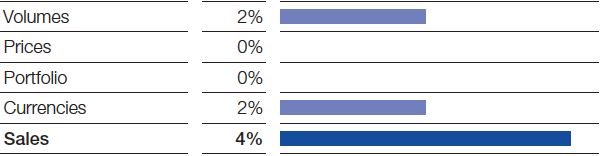

Compared with the first quarter of 2016, sales in the Agricultural Solutions segment grew slightly despite a market environment that remained difficult. The main drivers here were higher volumes and positive currency effects, with prices stable.

Factors influencing sales, Agricultural Solutions 1st Quarter 2017

Sales in Europe nearly matched the level of the previous first quarter. We raised volumes considerably in central and eastern Europe, especially for herbicides. By contrast, western Europe posted a volumes decline.

Positive currency effects and increased demand led to considerable sales growth in North America. Higher volumes arose primarily from solid business development for herbicides, especially the new solutions EngeniaTM und Zidua® PRO.

Sales rose considerably in Asia. This was largely attributable to higher volumes of fungicides due to earlier demand in China and the launch of the new Seltima® formulation in India, as well as to solid sales volumes for herbicides in Indonesia and Australia.

In the region South America, Africa, Middle East, a considerable increase in sales was mainly the result of positive currency effects from the Brazilian real. Higher volumes of herbicides in Argentina and of insecticides in Africa and the Middle East contributed to the increase, while lower prices dampened sales development.

Income from operations before special items declined slightly compared with the strong first quarter of 2016. This was the result of lower average margins due to a different product mix. Fixed costs rose slightly, due in part to the startup of new plants.

|

|

1st Quarter |

||||||

|---|---|---|---|---|---|---|---|---|

|

|

2017 |

2016 |

Change % |

||||

|

||||||||

Sales to third parties |

|

1,855 |

1,780 |

4 |

||||

Income from operations before depreciation and amortization (EBITDA) |

|

595 |

645 |

(8) |

||||

Amortization and depreciation1 |

|

64 |

55 |

16 |

||||

Income from operations (EBIT) |

|

531 |

590 |

(10) |

||||

Special items |

|

(2) |

(1) |

(100) |

||||

EBIT before special items |

|

533 |

591 |

(10) |

||||

Assets (March 31) |

|

10,012 |

9,316 |

7 |

||||

Investments including acquisitions2 |

|

36 |

77 |

(53) |

||||

Research and development expenses |

|

109 |

114 |

(4) |

||||