Results of Operations, Net Assets, Financial Position

Results of Operations

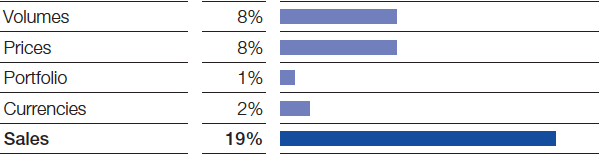

Compared with the first quarter of 2016, sales grew by €2,649 million to €16,857 million. We were able to increase sales volumes in all segments and raise prices, especially in the Chemicals segment. Currency effects and the Chemetall business acquired from Albemarle in December 2016 also had a positive impact on sales.

Factors influencing sales BASF Group 1st Quarter 2017

Income from operations (EBIT) before special items1 grew by €551 million to €2,457 million, primarily as a result of the substantially improved contribution from the Chemicals segment. EBIT before special items also rose considerably in the Oil & Gas and Functional Materials & Solutions segments, while Performance Products and Agricultural Solutions posted a slight decline. Earnings in the chemicals business2 contained an initial insurance payment of €100 million for the accident at the North Harbor of the Ludwigshafen site in October 2016, an amount which predominantly pertained to the Chemicals segment.

Special items in EBIT totaled minus €6 million in the first quarter of 2017, compared with minus €40 million in the same period of 2016. Expenses for restructuring measures, integration costs, and other expenses and income were partly offset by gains from divestitures.

EBIT grew by €585 million to €2,451 million compared with the first quarter of 2016.

Year-on-year, income from operations before depreciation, amortization and special items (EBITDA before special items)1 increased by €664 million to €3,507 million and EBITDA1 increased by €690 million to €3,502 million. At minus €152 million, the financial result was €36 million better than in the first quarter of 2016.

Income before taxes and minority interests rose by €621 million to €2,299 million. The tax rate grew from 15.4% to 22.9%, mainly due to higher taxes in Norway.

Net income rose by €322 million to €1,709 million.

Earnings per share were €1.86 in the first quarter of 2017, compared with €1.51 in the same quarter of 2016. Adjusted for special items and amortization of intangible assets, earnings per share1 amounted to €1.97 (first quarter of 2016: €1.64).

Net Assets

Compared with the end of 2016, total assets rose from €76,496 million to €79,074 million. At €50,399 million, noncurrent assets matched the level of December 31, 2016. Growth of €2,729 million in current assets, which totaled €28,675 million, resulted primarily from the increase in trade accounts receivable that accompanied the considerable rise in sales.

Financial Position

Equity increased from €32,568 million to €34,564 million compared with December 31, 2016. The equity ratio grew from 42.6% to 43.7%.

Noncurrent liabilities rose from €28,611 million to €29,778 million. This was largely the result of the increase in noncurrent financial indebtedness due to the issue of bonds with a nominal value totaling €1.9 billion. Among these were bonds of $600 million with nondilutive warrants due in 2023. Upon exercise, the warrants will be cash-settled only; no new shares will be issued, nor will existing shares of BASF SE be delivered. As a hedge, BASF has purchased corresponding call options.

Current liabilities declined from €15,317 million to €14,732 million. This was mainly the result of lower current financial indebtedness, brought about primarily by the scheduled repayment of short-term bonds as well as the scaling back of the U.S. dollar commercial paper program.

Total financial indebtedness rose by €498 million to €16,810 million. Net debt1 grew by €532 million to €14,933 million compared with December 31, 2016.

In the first quarter of 2017, cash provided by operating activities amounted to €833 million, €213 million below the first quarter of 2016. This was largely due to the higher amount of cash tied up in net working capital compared with the previous first quarter, especially in trade accounts receivable.

Cash used in investing activities in the first quarter of 2017 amounted to €1,215 million, compared with €1,258 million in the first quarter of 2016. This was the result of lower payments made for property, plant and equipment and intangible assets, which, at €767 million, were €234 million below the level of the previous first quarter. Contrasting this was, primarily, the €159 million increase in payments made for financial assets and other items.

Cash provided by financing activities declined from €1,997 million in the first quarter of 2016 to €831 million. The first quarter of 2017 saw a cash inflow of €811 million resulting from an increase in financial indebtedness as well as in other financing-related liabilities. The same quarter of the previous year had contained cash inflow arising primarily from the greater use of BASF SE’s U.S. dollar commercial paper program as well as from issuing a new bond.

Free cash flow1 amounted to €66 million, compared with €45 million in the same quarter of 2016.

Our ratings have remained unchanged since the publication of the BASF Report 2016. Rated “A1/P-1/outlook stable” by Moody’s, “A/A-1/outlook stable” by Standard & Poor’s and “A/S-1/outlook stable” by Scope, BASF enjoys good credit ratings, especially compared with competitors in the chemical industry.

1 For more on this figure, see Additional Key Figures.

2 Our chemicals business comprises the Chemicals, Performance Products and Functional Materials & Solutions segments.