Chemicals

1st Quarter 2017

Sales in the Chemicals segment considerably exceeded the level of the previous first quarter, largely as a result of higher prices in the Petrochemicals and Monomers divisions. Sales were furthermore supported by the higher level of sales volumes in all divisions. Currency effects slightly boosted sales. Due to higher margins and volumes, income from operations (EBIT) before special items grew considerably compared with the first quarter of 2016, especially in the Monomers division. The negative impact on earnings in the first quarter of 2017 caused by the accident at the North Harbor of the Ludwigshafen site was offset by an initial insurance payment for the damages occurring in the fourth quarter of 2016. Fixed costs were up year-on-year, due primarily to the startup of new plants.

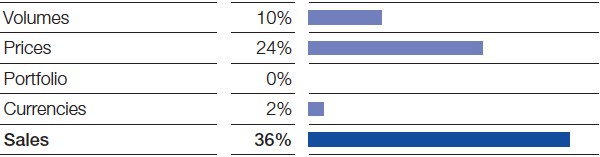

Factors influencing sales, Chemicals 1st Quarter 2017

Petrochemicals

The Petrochemicals division raised its sales considerably compared with the previous first quarter. A sharp increase in prices for raw materials such as naphtha, along with solid demand, led to higher sales prices – especially for steam cracker products. Volumes were slightly up compared with the previous first quarter. Margins improved for steam cracker products in all regions as well as for acrylic monomers in Asia. The first insurance payment for the accident at the North Harbor resulted in lower fixed costs. EBIT before special items grew considerably as an effect of the higher margins and a significantly increased earnings contribution from our share in BASF-YPC Company Ltd., based in Nanjing, China.

Monomers

Compared with the first quarter of 2016, sales in the Monomers division increased considerably. This was mainly the result of higher prices, especially for isocyanates. Sales volumes rose sharply, primarily for isocyanates and polyamides. EBIT before special items grew considerably as a consequence of increased margins. Earnings were also positively influenced by the restructuring of our caprolactam production in Europe. Predominantly on account of maintenance measures, fixed costs were higher than in the previous first quarter.

Intermediates

Sales in the Intermediates division also rose considerably year-on-year, mostly through substantial volumes growth in all regions and product lines. Overall, sales prices matched the level of the previous first quarter. EBIT before special items fell considerably, largely dampened by higher fixed costs arising from the startup of new facilities in all regions as well as from shutdowns. The ongoing intensely competitive environment and increased raw material prices both weighed down margins, especially for butanediol and derivatives.

|

|

1st Quarter |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

|

2017 |

2016 |

Change % |

||||||

|

||||||||||

Sales to third parties |

|

4,105 |

3,019 |

36 |

||||||

Thereof Petrochemicals |

|

1,654 |

1,196 |

38 |

||||||

Monomers |

|

1,699 |

1,177 |

44 |

||||||

Intermediates |

|

752 |

646 |

16 |

||||||

Income from operations before depreciation and amortization (EBITDA) |

|

1,239 |

719 |

72 |

||||||

Amortization and depreciation2 |

|

265 |

259 |

2 |

||||||

Income from operations (EBIT) |

|

974 |

460 |

112 |

||||||

Special items |

|

16 |

3 |

433 |

||||||

EBIT before special items |

|

958 |

457 |

110 |

||||||

Assets (March 31) |

|

13,468 |

12,148 |

11 |

||||||

Investments including acquisitions3 |

|

183 |

276 |

(34) |

||||||

Research and development expenses |

|

29 |

36 |

(19) |

||||||