BASF Group Business Review 1st Quarter 2015

In the first quarter of 2015, higher volumes and positive currency effects led to sales growth. Because of the sharp drop in the price of oil, prices fell, especially for basic chemicals. Increased earnings in the chemicals1 and crop protection businesses were not able to fully offset the considerable decline in Other.

1 Our chemicals business comprises the Chemicals, Performance Products and Functional Materials & Solutions segments.

Sales and income from operations before special items

- Sales rise by 3% to €20.1 billion, supported by higher gas trading volumes

- Earnings down by 2% quarter-on-quarter to around €2.1 billion due to higher charges from LTI program

Compared with the first quarter of 2014, our sales grew by 3% to €20.1 billion, despite a slight volumes decline in the chemicals business. This growth was mainly due to increased volumes and positive currency effects. Negative price effects arose from lower prices for crude oil and natural gas. The considerable sales decline in Other was primarily attributable to lower volumes and portfolio changes.

Income from operations before special items was down by €42 million to just under €2.1 billion as a result of considerably higher charges from Other, mainly due to higher provisions for our long-term incentive (LTI) program as a result of the positive performance of BASF shares. We were able to considerably raise earnings in the chemicals business and in the Agricultural Solutions segment.

Factors influencing sales

Factors influencing sales in 2015 (% of sales) |

||

|---|---|---|

|

|

1st Quarter |

Volumes |

|

5 |

Prices |

|

(8) |

Portfolio |

|

(1) |

Currencies |

|

7 |

|

|

3 |

Sales volumes grew compared with the first quarter of 2014. This was predominantly through a sharp increase in volumes in the Oil & Gas segment, especially in the Natural Gas Trading business sector. By contrast, volumes declined slightly in the chemicals business. As a consequence of the significantly lower prices of oil and gas, prices declined overall, especially in the Chemicals and Oil & Gas segments. Positive currency effects were observed in all segments. The disposal of our share in the Ellba Eastern Private Ltd. joint operation in Singapore slightly reduced sales.

Sales and income from operations before special items in the segments

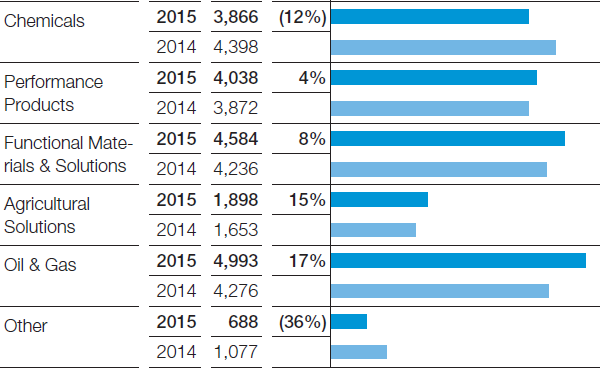

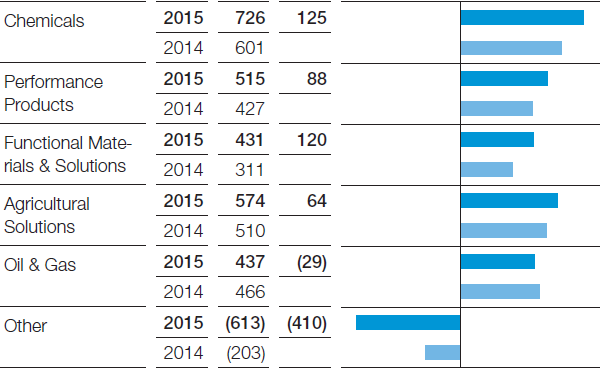

Sales in the Chemicals segment fell considerably below the level of the previous first quarter. This was largely due to falling prices on account of a sharp drop in raw material prices. Portfolio measures in the Petrochemicals division, along with slightly lower sales volumes overall, put an additional strain on sales. Currency effects were positive. Improved margins for a range of product lines, especially in Europe, led to a considerable rise in income from operations before special items.

First-quarter sales (million €, relative change)

Sales grew slightly in the Performance Products segment. Positive currency effects in all divisions more than offset slightly lower overall sales volumes and declining prices. We were able to considerably improve income from operations before special items. Aside from lower raw material costs, this was largely the result of efficiency and restructuring measures in all divisions.

In the Functional Materials & Solutions segment, we achieved considerably higher sales quarter-on-quarter as a result of positive currency effects in all divisions. Volumes and prices dipped slightly overall. Higher demand, primarily from the automotive industry, was not able to compensate for lower sales volumes in precious metal trading. We significantly improved income from operations before special items. The Performance Materials division provided major support for this growth.

Sales in the Agricultural Solutions segment rose considerably as a result of increased contributions from Europe and North America. We posted volumes growth in all indications. Positive currency effects and higher prices provided additional momentum to sales growth. We were able to considerably improve income from operations before special items, largely because of increased volumes and prices as well as favorable exchange rate developments.

In the Oil & Gas segment, sales grew considerably on account of higher volumes, mainly in the Natural Gas Trading business sector. Income from operations before special items declined slightly. A greater earnings contribution from Natural Gas Trading was not able to fully offset the primarily oil price-related decrease in the Exploration & Production business sector.

Sales in Other fell considerably compared with the previous first quarter. This resulted mainly from lower volumes as well as the disposal of our share in the Ellba Eastern Private Ltd. joint operation in Singapore at the end of 2014. Income from operations before special items declined considerably, largely because of valuation effects for the long-term incentive (LTI) program.

First-quarter EBIT before special items (million €, absolute change)

Income from operations and special items

Special items in EBIT amounted to minus €75 million in the first quarter of 2015, and especially contained expenses for the employee bonus on the occasion of BASF’s 150th anniversary. The previous first quarter had included tax-free special income from the disposal of shares in non-BASF-operated oil and gas fields in the British North Sea.

EBIT fell by €226 million to €1,995 million compared with the first quarter of 2014. EBITDA declined by €61 million to €2,890 million.

Special items reported in earnings before taxes (million €) |

|||

|---|---|---|---|

|

|

2015 |

2014 |

1st quarter |

|

(75) |

67 |

2nd quarter |

|

|

(79) |

3rd quarter |

|

|

(29) |

4th quarter |

|

|

507 |

Full year |

|

|

466 |

Financial result and net income

At minus €164 million, the financial result was above the level of the first quarter of 2014 (minus €183 million). This was due to the significant improvement in the interest result and a slight increase in other financial result. Income from shareholdings declined.

Income before taxes and minority interests fell by €207 million quarter-on-quarter to €1,831 million. The tax rate was at 29.7% (first quarter of 2014: 25.1%). This was largely the result of higher deferred taxes in the Oil & Gas segment as well as lower tax-free special income as compared with the previous first quarter.

Because of higher income taxes and increased minority interests, net income fell by €290 million to €1,174 million.

Earnings per share were €1.28 in the first quarter of 2015, compared with €1.59 in the same period of 2014. Adjusted for special items and amortization of intangible assets, earnings per share amounted to €1.43 (first quarter of 2014: €1.63).

Adjusted earnings per share (€) |

|||

|---|---|---|---|

|

|

2015 |

2014 |

1st quarter |

|

1.43 |

1.63 |

2nd quarter |

|

|

1.53 |

3rd quarter |

|

|

1.24 |

4th quarter |

|

|

1.04 |

Full year |

|

|

5.44 |