Agricultural Solutions

3rd Quarter 2017

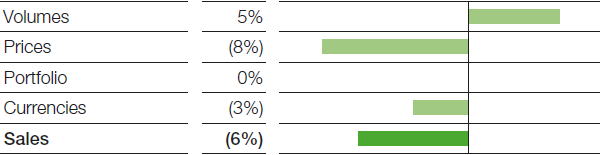

In the Agricultural Solutions segment, sales were down considerably on the third quarter of 2016, primarily as a result of declining prices and volumes in Brazil. Negative currency effects put additional pressure on sales development. We were able to slightly increase overall volumes.

Factors influencing sales, Agricultural Solutions

3rd Quarter 2017

Sales rose considerably in Europe. This was mainly due to higher herbicide and fungicide volumes, particularly in central and eastern Europe.

Sales in North America were up slightly on the prior-year quarter. We increased herbicide volumes with our innovation Engenia® and fungicide volumes with Xemium®. Negative currency effects slowed sales growth.

Business in the region South America, Africa, Middle East continued to be dominated by the difficult situation in Brazil; sales decreased considerably. With the market environment deteriorating, farmers’ economic situation remained strained and competitive pressure was high. This pushed down prices and sales volumes, especially of fungicides and insecticides. Negative currency effects also contributed to the decline in sales.

We increased sales considerably in Asia, mainly due to volumes growth with fungicide innovations in India as well as higher volumes in South Korea and Southeast Asia.

Income from operations before special items declined considerably year-on-year. This was primarily due to the difficult market situation in Brazil. Earnings were also negatively impacted by the shutdowns of our production facilities in Beaumont, Texas, and Manatí, Puerto Rico, because of the hurricanes. Fixed costs were on a level with the prior-year quarter.

|

|

3rd Quarter |

January – September |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

2017 |

2016 |

Change % |

2017 |

2016 |

Change % |

||||

|

|||||||||||

Sales to third parties |

|

987 |

1,049 |

(6) |

4,368 |

4,288 |

2 |

||||

Income from operations before depreciation and amortization (EBITDA) |

|

85 |

151 |

(44) |

1,016 |

1,169 |

(13) |

||||

Amortization and depreciation1 |

|

65 |

58 |

12 |

195 |

198 |

(2) |

||||

Income from operations (EBIT) |

|

20 |

93 |

(78) |

821 |

971 |

(15) |

||||

Special items |

|

(1) |

(4) |

75 |

(5) |

(37) |

86 |

||||

EBIT before special items |

|

21 |

97 |

(78) |

826 |

1,008 |

(18) |

||||

Assets (September 30) |

|

7,454 |

8,117 |

(8) |

7,454 |

8,117 |

(8) |

||||

Investments including acquisitions2 |

|

35 |

55 |

(36) |

121 |

206 |

(41) |

||||

Research and development expenses |

|

124 |

116 |

7 |

362 |

346 |

5 |

||||