Chemicals

3rd Quarter 2017

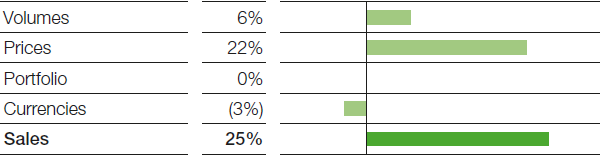

Sales in the Chemicals segment were up significantly on the prior-year quarter. This was largely due to higher prices in all divisions, especially in Monomers. We also significantly increased sales volumes. Currency effects slightly dampened sales in all divisions. Income from operations (EBIT) before special items rose considerably. This was mainly a result of higher margins, especially in the Monomers division. The negative impact on earnings in the third quarter of 2017 caused by the North Harbor accident at the Ludwigshafen site was compensated by insurance payments. Fixed costs rose slightly.

Factors influencing sales, Chemicals

3rd Quarter 2017

Petrochemicals

In the Petrochemicals division, sales considerably exceeded the prior-year figure due to higher prices and volumes. Contributing significantly to this development were steam cracker products in Europe, where we achieved higher sales prices and volumes. EBIT before special items increased considerably. This was largely due to a decrease in fixed costs resulting primarily from insurance payments in connection with the accident at the North Harbor. Margins improved worldwide, particularly for acrylic monomers and steam cracker products in Europe.

Monomers

Sales in the Monomers division rose considerably compared with the third quarter of 2016, mostly as a result of strong price increases in the isocyanates business. The isocyanates business also drove considerable volumes growth, largely through our new production facilities. There was a considerable increase in EBIT before special items. This was mainly due to higher margins, particularly for isocyanates. Earnings were also positively impacted by the restructuring of our caprolactam production in Europe. Fixed costs were above the level of the prior-year quarter.

Intermediates

We also achieved considerable sales growth in the Intermediates division. This was due to price increases on the back of higher raw materials prices, particularly in the butanediol and derivatives business. Volumes were on a level with the prior-year quarter. Negative currency effects and the divestiture of the Evans City, Pennsylvania, site in the first quarter of 2017 slightly dampened sales growth. EBIT before special items rose considerably, mainly as a result of improved margins. This was contrasted by higher fixed costs from new plants and the expansion of capacities in the United States, Asia and Europe.

|

|

3rd Quarter |

January – September |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

2017 |

2016 |

Change % |

2017 |

2016 |

Change % |

||||||

|

|||||||||||||

Sales to third parties |

|

4,023 |

3,227 |

25 |

12,173 |

9,482 |

28 |

||||||

Thereof Petrochemicals |

|

1,525 |

1,310 |

16 |

4,759 |

3,828 |

24 |

||||||

Monomers |

|

1,770 |

1,255 |

41 |

5,177 |

3,666 |

41 |

||||||

Intermediates |

|

728 |

662 |

10 |

2,237 |

1,988 |

13 |

||||||

Income from operations before depreciation and amortization (EBITDA) |

|

1,430 |

761 |

88 |

4,054 |

2,197 |

85 |

||||||

Amortization and depreciation2 |

|

341 |

271 |

26 |

872 |

789 |

11 |

||||||

Income from operations (EBIT) |

|

1,089 |

490 |

122 |

3,182 |

1,408 |

126 |

||||||

Special items |

|

(13) |

2 |

. |

2 |

5 |

(60) |

||||||

EBIT before special items |

|

1,102 |

488 |

126 |

3,180 |

1,403 |

127 |

||||||

Assets (September 30) |

|

12,743 |

12,520 |

2 |

12,743 |

12,520 |

2 |

||||||

Investments including acquisitions3 |

|

232 |

253 |

(8) |

645 |

845 |

(24) |

||||||

Research and development expenses |

|

31 |

34 |

(9) |

91 |

106 |

(14) |

||||||