Performance Products

3rd Quarter 2017

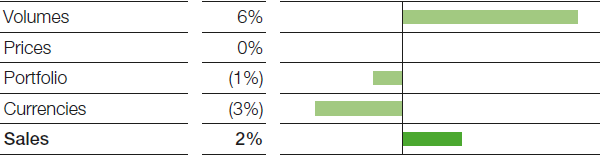

Sales in the Performance Products segment increased slightly compared with the third quarter of 2016 as a result of volumes growth in all divisions. Sales prices were on a level with the prior-year quarter: Price increases in the Dispersions & Pigments and Care Chemicals divisions were largely offset by significant price declines in the Nutrition & Health division. Currency effects, particularly from the U.S. dollar, and portfolio effects dampened sales growth. Income from operations (EBIT) before special items declined considerably. This was largely attributable to a further drop in vitamin prices as well as ongoing pressure on margins in a number of business areas due to higher raw materials prices. EBIT included special income in the Performance Chemicals division from the transfer of the leather chemicals business to the Stahl group.

Factors influencing sales, Performance Products

3rd Quarter 2017

Dispersions & Pigments

The Dispersions & Pigments division generated slight year-on-year sales growth. This was primarily due to volumes growth in all business areas, particularly in Asia and Europe. Higher raw materials prices pushed up sales prices slightly. Sales were dampened by currency effects and the divestiture of the photoinitiator business in August 2016. EBIT before special items rose slightly.

Care Chemicals

In the Care Chemicals division, sales were up slightly on the third quarter of 2016. This was the result of volumes growth and slightly higher prices as a result of increases in raw materials prices. We posted higher sales volumes, particularly of ingredients for the cosmetics as well as for the detergents and cleaners industries. Sales were dampened by negative currency effects. EBIT before special items saw a considerable, margin-related decline compared with the same quarter of the previous year.

Nutrition & Health

Sales in the Nutrition & Health division declined considerably as against the prior-year quarter. In addition to lower sales prices, especially for vitamins, this was attributable to portfolio effects and slightly negative currency effects. Virtually all business areas posted slight volumes growth. EBIT before special items was considerably below the level of the strong prior-year quarter, primarily due to lower margins. Higher fixed costs resulted from the gradual startup of the new aroma ingredients complex in Kuantan, Malaysia, as well as the expansion of capacities at our ibuprofen production facility in Bishop, Texas.

Performance Chemicals

Sales in the Performance Chemicals division rose slightly compared with the third quarter of 2016. This was driven by higher sales volumes in almost all business areas. We increased volumes for lubricants and additives in particular, as well as for oilfield and mining chemicals. Sales prices were on a level with the prior-year quarter; negative currency effects slightly dampened sales. EBIT before special items was down slightly on the third quarter of 2016. Reduced fixed costs only partially offset the lower margins brought about by higher raw materials prices.

|

|

3rd Quarter |

January – September |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

2017 |

2016 |

Change % |

2017 |

2016 |

Change % |

||||||

|

|||||||||||||

Sales to third parties |

|

3,983 |

3,921 |

2 |

12,385 |

11,817 |

5 |

||||||

Thereof Dispersions & Pigments |

|

1,339 |

1,297 |

3 |

4,173 |

3,913 |

7 |

||||||

Care Chemicals |

|

1,213 |

1,175 |

3 |

3,838 |

3,557 |

8 |

||||||

Nutrition & Health |

|

451 |

504 |

(11) |

1,401 |

1,489 |

(6) |

||||||

Performance Chemicals |

|

980 |

945 |

4 |

2,973 |

2,858 |

4 |

||||||

Income from operations before depreciation and amortization (EBITDA) |

|

788 |

688 |

15 |

2,111 |

2,152 |

(2) |

||||||

Amortization and depreciation2 |

|

221 |

221 |

– |

682 |

647 |

5 |

||||||

Income from operations (EBIT) |

|

567 |

467 |

21 |

1,429 |

1,505 |

(5) |

||||||

Special items |

|

182 |

(6) |

. |

124 |

(35) |

. |

||||||

EBIT before special items |

|

385 |

473 |

(19) |

1,305 |

1,540 |

(15) |

||||||

Assets (September 30) |

|

14,595 |

14,677 |

(1) |

14,595 |

14,677 |

(1) |

||||||

Investments including acquisitions3 |

|

143 |

199 |

(28) |

516 |

575 |

(10) |

||||||

Research and development expenses |

|

92 |

95 |

(3) |

282 |

291 |

(3) |

||||||