Chemicals

3rd Quarter 2016

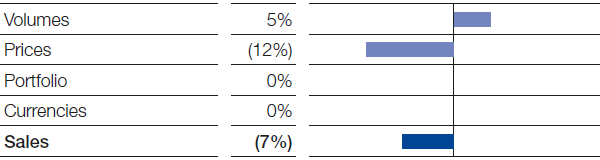

Sales in the Chemicals segment were considerably down compared with the third quarter of 2015. This was essentially due to lower prices on account of decreased raw material prices, especially in the Petrochemicals and Intermediates divisions. We were able to raise sales volumes overall. Income from operations (EBIT) before special items was considerably below the level of the previous third quarter, mostly due to reduced margins in the Petrochemicals and Intermediates divisions. Margins increased in the Monomers division, however. Fixed costs rose as a particular result of the startup of new production facilities.

Factors influencing sales, Chemicals

3rd Quarter 2016

Petrochemicals

Lower sales prices led to a considerable sales decline in the Petrochemicals division. Sales volumes rose, primarily due to the resumption of operations at the Ellba C.V. joint operation’s plant in Moerdijk, Netherlands. Volumes in North America declined mainly as a result of lower capacity utilization of the condensate splitter as well as unscheduled steam cracker shutdowns in Port Arthur, Texas. EBIT before special items was considerably below the level of the third quarter of 2015. In North America, earnings were negatively impacted by the lower levels of volumes and margins for steam cracker products, as well as lower margins for acrylic monomers and oxo alcohols. In Europe, margins for steam cracker products were not as strong as the previous third quarter, leading to a decline in earnings.

Monomers

The considerable year-on-year sales decrease in the Monomers division was primarily price-related. Developments for products in the polyamide value chain were a crucial factor. Here, our sales prices were reduced by a drop in raw material prices, and volumes declined mostly as a result of scheduled and unscheduled plant shutdowns. By contrast, we were able to raise volumes and prices for isocyanates. EBIT before special items grew considerably, thanks especially to the higher margins for isocyanates. Despite new production plant startups, fixed costs only slightly exceeded the level of the previous third quarter.

Intermediates

Sales fell considerably in the Intermediates division, as well, largely influenced by price decreases brought about by lower raw material prices. Prices were additionally weighed down by overcapacity on the market, especially for butanediol and its derivatives. We were able to raise volumes in all regions except South America. EBIT before special items was considerably below the level of the previous third quarter, largely because of lower margins for butanediol and its derivatives as well as higher fixed costs. These rose compared with the third quarter of 2015 partly as a result of new production facilities in the United States, Asia and Europe that have started up since the end of 2015.

|

|

|

3rd Quarter |

January – September | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|

2016 |

2015 |

Change % |

2016 |

2015 |

Change % | ||||

|

|||||||||||

|

Sales to third parties |

|

3,377 |

3,640 |

(7) |

9,899 |

11,481 |

(14) |

||||

|

Thereof Petrochemicals |

|

1,310 |

1,411 |

(7) |

3,828 |

4,606 |

(17) |

||||

|

Monomers |

|

1,405 |

1,522 |

(8) |

4,083 |

4,697 |

(13) |

||||

|

Intermediates |

|

662 |

707 |

(6) |

1,988 |

2,178 |

(9) |

||||

|

Income from operations before depreciation and amortization (EBITDA) |

|

776 |

867 |

(10) |

2,241 |

2,586 |

(13) |

||||

|

Amortization, depreciation and impairments1 |

|

277 |

236 |

17 |

807 |

681 |

19 |

||||

|

Income from operations (EBIT) |

|

499 |

631 |

(21) |

1,434 |

1,905 |

(25) |

||||

|

Special items |

|

2 |

(2) |

. |

5 |

(2) |

. |

||||

|

Income from operations (EBIT) before special items |

|

497 |

633 |

(21) |

1,429 |

1,907 |

(25) |

||||

|

Assets (September 30) |

|

12,869 |

12,817 |

0 |

12,869 |

12,817 |

0 |

||||

|

Investments2 |

|

258 |

524 |

(51) |

858 |

1,342 |

(36) |

||||

|

Research expenses |

|

44 |

50 |

(12) |

135 |

153 |

(12) |

||||