BASF Group Business Review 1st Half 2016

Both sales and earnings in the first half of 2016 reflected the lack of contributions from the natural gas trading and storage business as a result of the asset swap completed with Gazprom at the end of September 2015. The oil-price-related drop in sales prices additionally dampened business development. As a consequence, sales and income from operations (EBIT) before special items1 declined considerably, especially in the Oil & Gas segment. Thanks to considerably higher contributions from the Performance Products and Functional Materials & Solutions segments, earnings in the chemicals business2 reached the same level of the prior first half.

Sales and income from operations (EBIT) before special items

- Sales decline by 27% to €28.7 billion

- EBIT before special items down by 12% to €3.6 billion

Our sales decreased by 27% to €28.7 billion compared with the first half of 2015. This was predominantly due to the divestiture of the gas trading and storage business, which had contributed €7.2 billion to sales in the first half of 2015. In addition, the lower price of oil weighed down sales prices in the Chemicals segment in particular – an effect that was also seen in our other chemicals business as well as the Oil & Gas segment.

EBIT before special items declined by €0.5 billion to €3.6 billion, owing primarily to the substantially smaller contributions from the Oil & Gas and Chemicals segments, while Agricultural Solutions saw a slight decrease. We achieved significant earnings improvement in the Performance Products and Functional Materials & Solutions segments, as well as in Other, in the first half of 2016.

1 For more information on this KPI, see Alternative Performance Measures.

2 Our chemicals business comprises the Chemicals, Performance Products and Functional Materials & Solutions segments.

Factors influencing sales

|

|

|

1st Half |

|---|---|---|

|

Volumes |

|

1 |

|

Prices |

|

(7) |

|

Portfolio |

|

(19) |

|

Currencies |

|

(2) |

|

|

|

(27) |

Except for Agricultural Solutions, all segments contributed to a slight increase in sales volumes. Lower raw material prices, especially in the Chemicals segment, significantly reduced sales prices. Portfolio measures mainly comprised the divestiture of the natural gas trading and storage business. All segments experienced slightly negative currency effects.

Sales and income from operations (EBIT) before special items in the segments

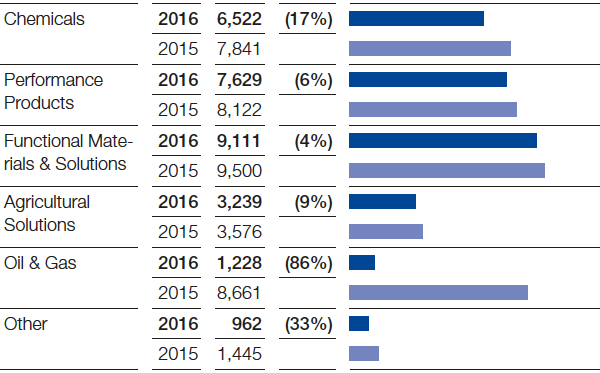

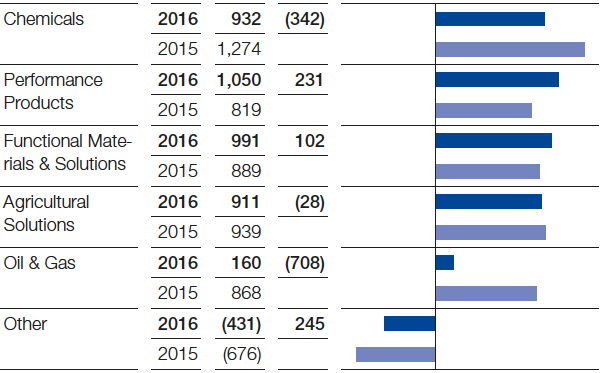

Sales fell considerably in the Chemicals segment, mainly on account of price reductions owing to lower raw material costs. Sales volumes slightly exceeded the level of the first half of 2015, boosted particularly by volumes growth in the Intermediates division. Primarily weighed down by decreased margins, EBIT before special items declined considerably. The startup of new production plants slightly raised fixed costs.

First-half sales (million €, relative change)

In the Performance Products segment, sales were considerably below prior first-half levels. This was largely attributable to lower prices driven down by oil-price-related declines in raw material costs, in addition to ongoing pressure on prices in the hygiene business. Sales development was also slowed by divestitures made in 2015 as well as by negative currency effects. Volumes rose slightly. As a result of reduced fixed costs, higher volumes and improved margins, we were able to considerably boost our EBIT before special items.

Sales were slightly down in the Functional Materials & Solutions segment, mainly as a consequence of the lower prices largely brought about by reduced prices in precious metal trading. An increase in volumes was mostly attributable to higher demand from the automotive and the construction industries. EBIT before special items rose considerably year-on-year, boosted predominantly by the contribution from the Performance Materials division.

In a market environment that remains difficult, we posted a considerable sales decline in the Agricultural Solutions segment compared with the previous first half. Price increases were unable to compensate for lower sales volumes and negative currency effects. EBIT before special items fell slightly, mainly due to the lower level of sales.

First-half EBIT before special items (million €, absolute change)

Sales in the Oil & Gas segment were considerably lower than in the first half of 2015, which had included €7.2 billion in sales from activities now discontinued since the asset swap with Gazprom. Sales were additionally reduced by the decline in oil and gas prices. We were able to ramp up our production volumes, especially in Norway. Income from operations before special items fell considerably, predominantly on account of lower prices as well as the discontinued contributions from the gas trading and storage business.

In Other, sales were considerably down compared with the first half of 2015. Lower prices and volumes in raw materials trading were largely responsible. EBIT before special items improved considerably. This was particularly attributable to valuation effects for the long-term incentive program as well as a better currency result.

Income from operations (EBIT) and special items

Special items in EBIT amounted to minus €29 million in the first half of 2016 (first half of 2015: minus €79 million). In addition to expenses for restructuring measures and to special charges, these also included gains on disposals.

Compared with the previous first half, EBIT declined by €450 million to €3,584 million. EBITDA1 fell by €282 million to €5,602 million.

1 For more information on this KPI, see Alternative Performance Measures.

Financial result and net income

At minus €365 million, the financial result was below the level of the first half of 2015 (minus €316 million). Responsible for this decline was a significant decrease in other financial result and net income from shareholdings, while the interest result remained constant.

Income before taxes and minority interests fell by €499 million to €3,219 million. The tax rate was 20.9% (first half of 2015: 28.2%), a drop that was mainly attributable to taxes in the Oil & Gas segment.

Net income rose by €40 million to €2,479 million.

Earnings per share were €2.70 in the first half of 2016, compared with €2.66 in the same period of 2015. Adjusted for special items and amortization of intangible assets, earnings per share amounted to €2.94 (first half of 2015: €2.92)1.

1 For more information on this KPI, see Alternative Performance Measures.