Corporate governance report

Corporate governance refers to the entire system for managing and supervising a company. This includes its organization, values, corporate principles and guidelines as well as internal and external control and monitoring mechanisms. Effective and transparent corporate governance guarantees that BASF is directed and monitored in a responsible manner focused on value creation. It fosters the confidence of our domestic and international investors, the financial markets, our customers and other business partners, employees, and the public in BASF.

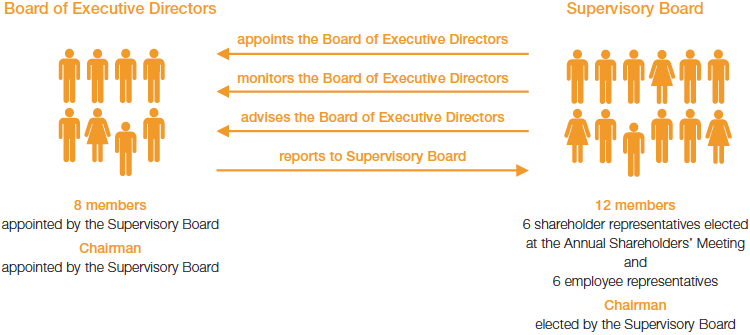

Board of Executive Directors

Manages company and represents BASF SE in business with third parties

Supervisory Board

Appoints, monitors and advises Board of Executive Directors

Shareholders

Exercise rights of co-administration and supervision at Annual Shareholders’ Meeting

The fundamental elements of BASF SE’s corporate governance system are: its two-tier system, with a transparent and effective separation of company management and supervision between BASF’s Board of Executive Directors and the Supervisory Board; the equal representation of shareholders and employees on the Supervisory Board; and the shareholders’ rights of co-administration and supervision at the Annual Shareholders’ Meeting.

Two-tier management system of BASF SE

Direction and management by the Board of Executive Directors

- Board of Executive Directors strictly separated from the Supervisory Board

- Responsible for company management

- Sets corporate goals and strategic direction

The Board of Executive Directors is responsible for the management of the company, and represents BASF SE in business undertakings with third parties. BASF’s Board of Executive Directors is strictly separated from the Supervisory Board, which monitors the activity of the Board of Executive Directors and decides on its composition. A member of the Board of Executive Directors cannot simultaneously be a member of the Supervisory Board. As the central duty of company management, the Board of Executive Directors agrees on the corporate goals and strategic direction of the BASF Group as well as its individual business areas; determines the company’s internal organization; and decides on the composition of management on the levels below the Board. It also manages and monitors BASF Group business by planning and setting the corporate budget, allocating resources and management capacities, monitoring and making decisions on significant individual measures, and supervising operational management.

The Board’s actions and decisions are geared toward the company’s best interests. It is committed to the goal of sustainably increasing the company’s value. Among the Board’s responsibilities is the preparation of the consolidated and separate financial statements of BASF SE. Furthermore, it must ensure that the company’s activities comply with the law and with internal corporate directives. This includes the establishment of appropriate systems for control, compliance and risk management.

Decisions that are reserved for the Board as a whole by law, through the Board of Executive Directors’ Rules of Procedure or through resolutions adopted by the Board, are made at regularly held Board meetings called by the Chairman of the Board of Executive Directors. Board decisions are generally based on detailed information and analyses provided by the business areas and specialist units, and, if deemed necessary, by external consultants. Board decisions can generally be made via a simple majority. In the case of a tied vote, the casting vote is given by the Chairman of the Board. However, the Chairman of the Board does not have the right to veto the decisions of the Board of Executive Directors. Members of the Board of Executive Directors are authorized to make decisions individually in their assigned areas of responsibility.

The Board can set up Board Committees to consult and decide on individual issues; these must include at least three members of the Board of Executive Directors. For the preparation of important decisions, such as those on acquisitions, divestitures, investments and personnel, the Board has various commissions at the level below the Board that carefully assess the planned measure and evaluate the associated opportunities and risks, and based on this information, report and make recommendations to the Board – independently of the affected business area.

The Board of Executive Directors informs the Supervisory Board regularly, without delay and comprehensively, of all issues important to the company with regard to planning, business development, risk situation, risk management and compliance. Furthermore, the Board of Executive Directors coordinates the company’s strategic orientation with the Supervisory Board.

The Statutes of BASF SE define certain transactions that require the Board of Executive Directors to obtain the Supervisory Board’s approval prior to their conclusion. Such cases include the acquisition and disposal of enterprises and parts of enterprises, as well as the issue of bonds or comparable financial instruments. However, this is only necessary if the acquisition or disposal price or the amount of the issue in an individual case exceeds 3% of the equity reported in the last approved Consolidated Financial Statements of the BASF Group.

The members of the Board of Executive Directors, including their areas of responsibility and memberships on the supervisory bodies of other companies, are listed under Management and Supervisory Boards.

Compensation of the Board of Executive Directors is described in detail in the Compensation Report