Financing policy and credit ratings

- Financing principles remain unchanged

- “A” ratings confirmed

Our financing policy is aimed at ensuring our solvency at all times, limiting the risks associated with financing and optimizing our cost of capital. We preferably meet our external financing needs on international capital markets.

We strive to maintain at least a solid “A” rating, which allows us unrestricted access to money and capital markets. Our financing measures are aligned with our operative business planning as well as the company’s strategic direction and also ensure the financial flexibility to take advantage of strategic options.

BASF has good credit ratings, especially in comparison with competitors in the chemical industry. Rating agency Moody’s last confirmed their rating of “A1/P-1/outlook stable” on November 28, 2016. Standard & Poor’s adjusted their BASF rating from “A+/A-1/outlook negative” to “A/A-1/outlook stable” on March 14, 2016, and confirmed it most recently on August 10, 2016. This adjustment was largely based on the weaker market environment, especially for basic and agricultural chemicals, limited overall volumes growth, and the considerable drop in the price of crude oil. Uncertainty with regard to economic development in China was taken into consideration, as well. Rating agency Scope has also been evaluating our creditworthiness since September 2016. They rated BASF at “A/S-1/outlook stable.”

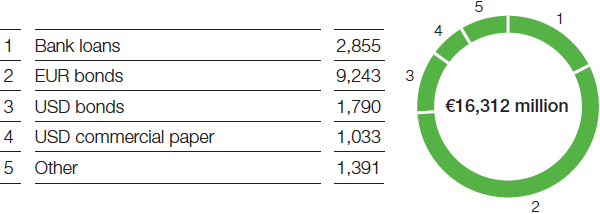

We have solid financing. Corporate bonds form the basis of our medium to long-term debt financing. These are issued in euros and other currencies with different maturities as part of our €20 billion debt issuance program. The goal is to create a balanced maturity profile and diverse range of investors, and to optimize our debt capital financing conditions.

For short-term financing, we use BASF SE’s U.S. dollar commercial paper program, which has an issuing volume of up to $12.5 billion. On December 31, 2016, $1,089 million worth of commercial paper was outstanding under this program. Firmly committed, syndicated credit lines of €6 billion serve to cover the repayment of outstanding commercial paper, and can also be used for general company purposes.

These credit lines were not used at any point in 2016. Our external financing is therefore largely independent of short-term fluctuations in the credit markets.

Off-balance-sheet financing tools, such as leasing, are of minor importance to us. BASF Group’s most important financial contracts contain no side agreements with regard to specific financial ratios (financial covenants) or compliance with a specific rating (rating trigger).

To minimize risks and exploit internal optimization potential within the Group, we bundle the financing, financial investments and foreign currency hedging of BASF SE’s subsidiaries within the BASF Group where possible. Foreign currency risks are primarily hedged centrally by means of derivative financial instruments in the market.

Our interest risk management generally pursues the goal of reducing interest expenses for the Group and limiting interest risks. Interest rate hedging transactions are therefore conducted with banks in order to turn selected liabilities to the capital markets from fixed interest to variable rate or vice versa.