Business review

Agricultural Solutions segment

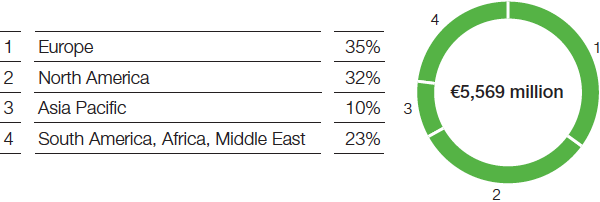

- Lower volumes and currency effects lead to 4% decline in sales to €5,569 million

- At €1,087 million, EBIT before special items matches prior-year level

In the Agricultural Solutions segment, sales to third parties in 2016 fell by €251 million to €5,569 million as a result of lower sales volumes and negative currency effects. The challenging market environment for crop protection products particularly dampened demand for insecticides in South America and for fungicides in Europe. Prices matched the level of 2015 (volumes −2%, prices 0%, currencies −2%).

Segment data (million €) |

|||||||||

|

|

|

2016 |

2015 |

Change in % |

||||

|---|---|---|---|---|---|---|---|---|---|

|

|||||||||

Sales to third parties |

|

|

5,569 |

5,820 |

(4) |

||||

Intersegmental transfers |

|

|

33 |

28 |

18 |

||||

Sales including intersegmental transfers |

|

|

5,602 |

5,848 |

(4) |

||||

Income from operations before depreciation and amortization (EBITDA) |

|

|

1,305 |

1,321 |

(1) |

||||

EBITDA margin |

|

% |

23.4 |

22.7 |

– |

||||

Depreciation and amortization1 |

|

|

268 |

238 |

13 |

||||

Income from operations (EBIT) |

|

|

1,037 |

1,083 |

(4) |

||||

Special items |

|

|

(50) |

(7) |

. |

||||

EBIT before special items |

|

|

1,087 |

1,090 |

0 |

||||

EBIT after cost of capital |

|

|

172 |

154 |

12 |

||||

Assets |

|

|

8,899 |

8,435 |

6 |

||||

Investments2 |

|

|

266 |

402 |

(34) |

||||

Research and development expenses |

|

|

489 |

514 |

(5) |

||||

In Europe, sales declined by €149 million to €1,958 million. This was mainly attributable to weaker demand for fungicides in the first half of the year. Especially in Germany and Poland, volumes fell as a result of unfavorable weather conditions and our customers’ high inventory levels. Price increases, primarily in central and eastern Europe, including Russia, were unable to offset the lower volumes and negative currency effects.

Sales in North America decreased by €69 million to €1,801 million, predominantly because of lower prices, especially for fungicides in the United States. Higher demand for fungicides and insecticides in the United States and for herbicides in Canada helped support volumes development.

At €549 million, sales in Asia exceeded the previous year’s level by €24 million. We were able to raise sales volumes in all indications, largely driven by substantially higher demand for herbicides in India and the overall positive volumes development in Indonesia and Australia. Currency effects slightly dampened sales.

In South America, sales fell by €57 million to €1,261 million, basically due to lower insecticide volumes in Brazil. This was primarily attributable to our customers’ high inventory levels and critical economic situation, as well as the shrinking market for insecticides in the region. Price increases were unable to fully compensate for the drop in volumes.

Strict cost management enabled us to reduce fixed costs in the Agricultural Solutions segment. Thanks to this development, income from operations (EBIT) before special items matched the previous year’s level at €1,087 million despite the sales decline. Due to special charges from the optimization of our production structure, EBIT decreased by €46 million to €1,037 million.