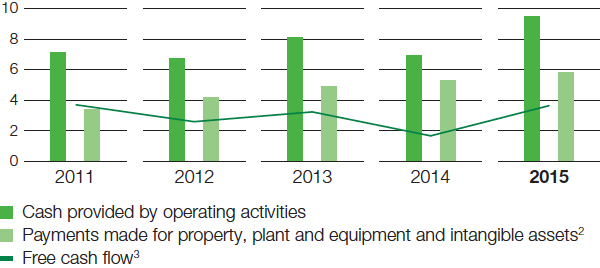

Statement of cash flows

- Cash provided by operating activities and free cash flow significantly exceed prior-year levels

At €9,446 million, cash provided by operating activities in 2015 was €2,488 million above the level of the previous year. This was largely attributable to a decrease in the amount of capital tied down in net working capital as a result of reduced inventories and other operating receivables. The line item “miscellaneous items” particularly contained the transfer of gains from the asset swap with Gazprom into cash used in investing activities. In the previous year, this item had primarily included the reclassification of gains from the disposal of our 50% share in Styrolution Holding GmbH.

Cash used in investing activities amounted to minus €5,235 million in 2015 compared with minus €4,496 million in 2014. Payments for property, plant and equipment and intangible assets were at €5,812 million, surpassing both the prior year’s level (€5,296 million) and the level of depreciation and amortization (€4,448 million).

Acquisitions and divestitures in 2015 resulted in net payments received of €436 million (2014: €373 million).

Cash inflow of €141 million from financial investments and other items in 2015 was primarily attributable to the decrease in other financial receivables. In 2014, the disposal of financial assets, other financial receivables, and miscellaneous items had led to €427 million in payments received.

Cash used in financing activities amounted to minus €3,673 million in 2015, compared with minus €2,478 million in the previous year. The contribution from minority interests to a capital increase in one Group company was primarily responsible for cash inflow of €66 million in 2015. Cash outflow from the change in financial indebtedness amounted to €933 million. This was largely from the scheduled repayment of two bonds; the expansion of BASF SE’s U.S. dollar commercial paper program had a countering effect. In 2015, dividends of €2,572 million were paid to shareholders of BASF SE and €234 million to minority interests.

In total, cash and cash equivalents increased by €523 million compared with the previous year, amounting to €2,241 million as of December 31, 2015.

Free cash flow rose by €1,972 million to €3,634 million in 2015 on account of higher cash provided by operating activities.

Cash flow1 (in billion €)

1 The figures for the 2011 business year were not restated according to the new accounting and reporting standards IFRS 10 and 11.

2 Including investments to the extent that they already had an effect on cash

3 Cash provided by operating activities less payments made for property, plant and equipment and intangible assets

Statement of cash flows (in million €) |

|||||

|

|

2015 |

2014 |

||

|---|---|---|---|---|---|

|

|||||

Net income |

|

3,987 |

5,155 |

||

Depreciation and amortization of intangible assets, property, plant and equipment, and financial assets |

|

4,448 |

3,455 |

||

Changes in net working capital1 |

|

1,347 |

(623) |

||

Miscellaneous items1 |

|

(336) |

(1,029) |

||

Cash provided by operating activities |

|

9,446 |

6,958 |

||

|

|

|

|

||

Payments for property, plant and equipment and intangible assets |

|

(5,812) |

(5,296) |

||

Acquisitions/divestitures |

|

436 |

373 |

||

Financial investments and other items |

|

141 |

427 |

||

Cash used in investing activities |

|

(5,235) |

(4,496) |

||

|

|

|

|

||

Capital increases/repayments, share repurchases |

|

66 |

− |

||

Changes in financial liabilities |

|

(933) |

288 |

||

Dividends |

|

(2,806) |

(2,766) |

||

Cash used in financing activities |

|

(3,673) |

(2,478) |

||

|

|

|

|

||

Net changes in cash and cash equivalents |

|

538 |

(16) |

||

Cash and cash equivalents at the beginning of the year and other changes |

|

1,703 |

1,734 |

||

Cash and cash equivalents at the end of the year |

|

2,241 |

1,718 |

||