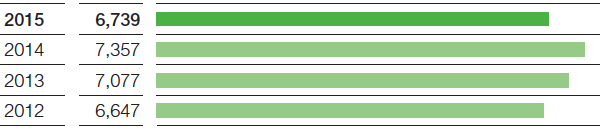

Sales and income from operations before special items

- Sales decline by 5% to €70,449 million

- At €6,739 million, income from operations before special items 8% below prior-year level

Sales decreased by €3,877 million to €70,449 million in 2015, largely on account of the significant drop in prices – especially in the Chemicals segment – in relation to oil price developments. In addition, the asset swap with Gazprom completed at the end of September particularly contributed to the decline. This transaction meant the discontinuation of contributions to the Oil & Gas segment mainly from the natural gas trading and storage business as of the fourth quarter of 2015. We could only partly compensate for this through sales increases in the other three segments.

At €6,739 million, income from operations before special items was 8% below the level of the previous year. Major influences here were the oil-price-related decline in sales from our oil and gas production as well as decreased earnings in Other, which was particularly the result of currency effects. Earnings increased slightly in the chemicals business1 but fell slightly in the Agricultural Solutions segment.

1 Our chemicals business comprises the Chemicals, Performance Products and Functional Materials & Solutions segments.

Factors influencing sales

Sales volumes in 2015 rose slightly overall, mainly as a result of higher volumes in the Oil & Gas segment. Volumes were slightly down overall in the chemicals business. Sales prices fell in nearly all divisions, strongly affected by the sharp drop in raw material prices. We were able to raise volumes and prices in the Agricultural Solutions segment. Currency effects positively influenced sales in all segments. Sales were reduced by the asset swap with Gazprom, through which contributions to the Oil & Gas segment from the gas trading and storage business in particular ceased as of the fourth quarter of 2015.

Factors influencing sales of the BASF Group |

|||

|

|

Change |

Change |

|---|---|---|---|

Volumes |

|

1,851 |

3 |

Prices |

|

(6,339) |

(9) |

Currencies |

|

4,280 |

6 |

Acquisitions |

|

387 |

1 |

Divestitures |

|

(3,948) |

(6) |

Changes in scope of consolidation |

|

(108) |

0 |

Total change in sales |

|

(3,877) |

(5) |

Sales and income from operations before special items in the segments

Sales in the Chemicals segment declined by 14%, largely due to lower prices on account of decreased raw material costs, especially in the Petrochemicals division. Income from operations before special items fell by 9% compared with the previous year. This was primarily attributable to the declining TDI margins in the Monomers division as well as rising fixed costs from the startup of new production plants, such as in Camaçari, Brazil, and Chongqing, China.

In the Performance Products segment, sales were up by 1%. Positive currency effects in all divisions were able to more than compensate for lower sales prices and weaker volumes. Income from operations before special items was 6% below the prior year’s level because of higher fixed costs. These resulted from negative currency effects, the startup of new plants – such as those in Camaçari, Brazil, and Freeport, Texas – and inventory reductions.

We raised sales by 5% in the Functional Materials & Solutions segment thanks to positive currency effects in all divisions. Prices declined slightly overall, with volumes stable. We improved income from operations before special items by 38%, mainly because of the considerable earnings increase in the Performance Materials and Construction Chemicals divisions.

Sales in the Agricultural Solutions segment exceeded the level of 2014 by 7%, primarily driven by higher sales prices. Over the course of the year, we experienced a slowdown in demand for crop protection products, while prices for agricultural products remained low. In emerging markets in particular, our business development was hindered by the volatile environment and depreciation of local currencies. Income from operations before special items was down by 2%. This was primarily attributable to higher fixed costs, mainly through a decrease in plant capacity utilization rates from the startup of new production capacities, along with reductions in inventories.

Sales declined by 14% in the Oil & Gas segment in 2015. This was largely a result of the asset swap with Gazprom completed at the end of September, through which contributions from the natural gas trading and storage business, as well as from Wintershall Noordzee B.V., ceased as of the fourth quarter of 2015. The significant drop in the price of oil led to slightly lower sales in the Exploration & Production business sector. Higher volumes in both the Exploration & Production and Natural Gas Trading business sectors had a positive effect on sales. Income from operations before special items declined by 24% as a result of the reduced sales level.

Sales in Other shrank by 23%, mainly on account of a reduced contribution from raw materials trading. The decline was also influenced by the disposal of our share in the Ellba Eastern Private Ltd. joint operation in Singapore at the end of 2014, as well as by lower plant availability from the outage at the Ellba C.V. joint operation in Moerdijk, Netherlands. Income from operations before special items dropped by 57% compared with the previous year. Major factors were a lower currency result and higher expenses for provisions for our long-term incentive program.

Business review Chemicals

Business review Performance Products

Business review Functional Materials & Solutions

Business review Agricultural Solutions

Business review Oil & Gas