Catalysts

- Sales rise by €171 million to €6,306 million, boosted mainly by positive currency effects

- Considerable earnings decline due in part to lower contribution from precious metal trading

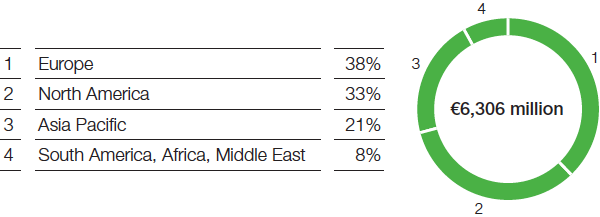

In the Catalysts division, sales to third parties rose by €171 million to €6,306 million in 2015, mostly through highly positive currency effects from the U.S. dollar (volumes –2%, prices –8%, portfolio 1%, currencies 12%).

The decline in volumes and prices in the Catalysts division was largely attributable to lower volumes and prices in precious metal trading, reducing this business’s contribution by €187 million to €2,388 million. Greater sales volumes of mobile emissions catalysts in Europe and Asia positively affected sales. We posted a decline in volumes of chemical and refinery catalysts, especially in Asia.

Income from operations before special items dropped considerably compared with the previous year, due in particular to lower contributions from precious metal trading and battery materials. The decline in precious metal trading was essentially the result of lower precious metal prices. In the battery materials business, fixed costs rose partly on account of increased investment in research and development. The gradual startup of plants in Środa Śląska, Poland, and Ludwigshafen, Germany, for mobile emissions catalysts and chemical catalysts also contributed significantly to the rise in fixed costs. Special charges arose mainly through an impairment on intangible assets.

In February 2015, we acquired from TODA KOGYO CORP. a 66% share in a company that specializes in cathode materials for lithium-ion batteries in Japan, thus expanding our global battery materials network.