Value-based management

“We add value as one company” is one of the four principles of our “We create chemistry” strategy. To create value in the long term, a company’s earnings must exceed the cost of stockholders’ equity and borrowing costs. This is why we strive to earn a high premium on our cost of capital. To ensure BASF’s long-term success, we encourage and support all employees in thinking and acting entrepreneurially in line with our value-based management concept. Our goal: to create awareness as to how each and every employee can find value-oriented solutions in the company’s day-to-day operations and implement these in an effective and efficient manner.

EBIT after cost of capital

- Performance and management indicator

Earnings before interest and taxes (EBIT) after cost of capital is a key performance and management indicator for the BASF Group and its operating divisions and business units. This figure combines the company’s economic situation as summarized in EBIT with the costs for the capital made available to us by shareholders and creditors. When we earn a premium on our cost of capital, we exceed the return expected by our shareholders.

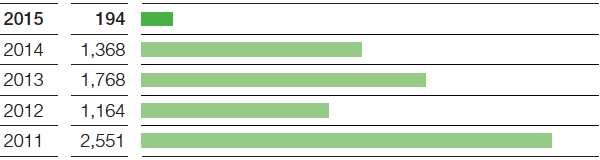

EBIT after cost of capital1 (in million €)

Five-year summary

1 The figure for 2011 was not restated in accordance with IFRS 10 and 11.

Calculation of cost of capital percentage

The cost of capital percentage (weighted average cost of capital, WACC) is determined using the weighted cost of capital from equity and borrowing costs. The cost of equity is ascertained using the Capital Asset Pricing Model. Borrowing costs are determined based on the financing costs of the BASF Group.

EBIT after cost of capital, which we use as a steering parameter, is a pretax figure. Therefore, we use the current average tax rate to derive the pretax cost of capital percentage from the WACC. In 2015, this cost of capital percentage was 11%; in 2016, this figure will be 10% due to lower capital market interest rates. Based on this, an EBIT threshold is calculated which must then be reached by all operating units put together in order to earn the cost of capital of the BASF Group.

Calculation of EBIT after cost of capital (in million €) |

|||||||

|

|

2015 |

2014 |

||||

|---|---|---|---|---|---|---|---|

|

|||||||

EBIT BASF Group |

|

6,248 |

7,626 |

||||

– Less EBIT for activities not assigned to the segments1 |

|

(985) |

(133) |

||||

– Less cost of capital2 |

|

7,039 |

6,391 |

||||

EBIT after cost of capital |

|

194 |

1,368 |

||||

Value-based management throughout the company

- Exercising a value-oriented mindset in day-to-day business by every employee

For us, value-based management means the daily focus placed on value by all of our employees. To this end, we have identified value drivers that show how each and every unit in the company can create value. We develop performance indicators for the individual value drivers that help us to plan and pursue changes.

An important factor in ensuring the successful implementation of value-based management is linking the goals of BASF to the individual target agreements of employees. In the operating units, the most important performance indicators are the achievement of a positive EBIT after cost of capital and a competitive level of profitability. By contrast, the functional units’ contribution to value is assessed on the basis of effectiveness and efficiency.

All this forms a consistent system of value drivers and key indicators for the individual levels and functions at BASF. In addition to EBIT after cost of capital, EBIT and EBIT before special items are the most significant performance indicators for measuring economic success as well as for steering the BASF Group and its operating units.

We primarily comment on EBIT before special items on a segment and division level in our financial reporting because this figure is adjusted for influences not associated with typical business operations. This makes it particularly suitable for describing financial development over time. In addition to EBIT before special items, we also report on sales as a further main driver for EBIT after cost of capital. BASF’s nonfinancial targets are focused more on the long term, and are not used for short-term steering.

According to our value-based management concept, all employees can make a contribution in their business area to help ensure that we earn the targeted premium on our cost of capital. We pass this value-based management concept on to our team around the world through seminars and training events, thereby promoting entrepreneurial thinking at all levels within BASF. ![]()