Business expansion in emerging markets

In the years ahead, we want to grow even more vigorously in the emerging markets and further expand our position there. Today’s emerging markets are expected to account for around 60% of global chemical production in 2020. We aim to benefit from the above-average growth in these regions and therefore plan to invest more than a quarter of our capital expenditures there between 2016 and 2020.

The weakening of the emerging markets continued in 2015. In China, growth slowed down as part of the orientation toward a more consumption-oriented growth model. This dampened growth not only in Asia, but also in the emerging markets of South America that export raw materials. While the Argentinian economy was able to stabilize at a low level, Brazil slid into a sharp recession that intensified toward the end of the year as domestic and foreign demand weakened. Russia, too, experienced a significant decline in its gross domestic product in light of low oil prices and ongoing mutual trade sanctions on the part of the E.U. and United States.

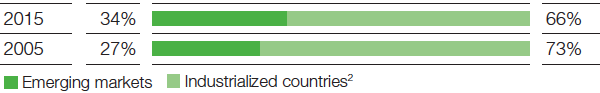

Compared with 2014, sales at our companies headquartered in the emerging markets rose by 3% to €16,230 million. This was largely the result of positive currency effects and increased volumes. Measured by customer location, sales (excluding the Oil & Gas segment) in the emerging markets grew by 2% to €19,572 million. This brought sales to customers in emerging markets to around 34% of total sales (excluding Oil & Gas) in 2015. In the years ahead, we want to continue expanding this percentage.