Outlook for the chemical industry

- Global growth slightly below the level of 2015

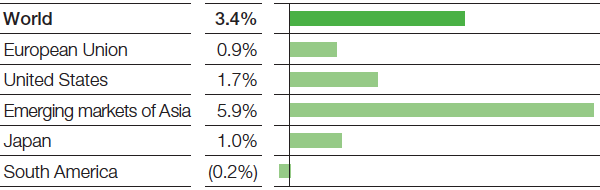

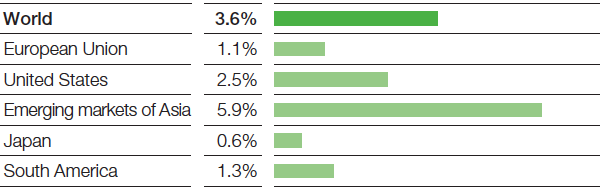

Global chemical production (excluding pharmaceuticals) will probably grow by 3.4% in 2016, slightly slower than in 2015 (+3.6%). We expect production in the advanced economies to expand by 1.3%, somewhat slower than in the previous year (+1.6%). At 5.0%, overall growth in the emerging markets will also approximate prior-year levels.

The global growth rate of the chemical market will be largely determined by developments in China, which accounts for more than a third of worldwide production. China will presumably contribute more than two percentage points to the rate of global chemical industry growth in 2016. All growth forecasts for China are currently fraught with high levels of uncertainty; this applies to our prognosis for global chemical growth, as well.

Chemical production in the European Union is likely to grow only slowly in 2016. Demand from customer industries in the region will grow moderately, yet we do not anticipate any additional growth stimulus beyond this from the export business for Europe’s chemical producers. Overall, competitive pressure could remain high on an international level, even as European chemical sites – as in the previous year – benefit from low oil prices compared with U.S. competitors whose production is based on gas.

We expect chemical production to expand in the United States against the backdrop of solidly growing demand overall from customer industries. However, momentum let up considerably over the course of 2015, which may be reflected in a lower growth rate for 2016.

Chemical growth will decelerate somewhat overall in the emerging markets of Asia. While it will probably continue to shrink in China, it will hover around prior-year levels in the region’s other countries. The higher growth rates we expect for the automotive industry will support demand for chemicals. Slower construction activity in China will presumably have a dampening effect. In Japan, we anticipate a weak economic environment overall and minimal growth in chemical production.

The chemical industry in South America will stagnate overall. Demand is likely to remain weak in Argentina; in Brazil, it will continue to decline. In the other South American countries, however, we expect solid growth on average.