Economic environment in 2016

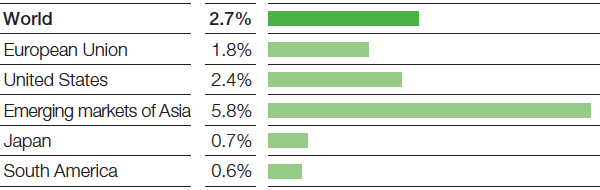

The global economy will presumably grow by 2.3% in 2016, about as fast as in 2015 (+2.4%). Growth in the European Union will remain comparable with prior-year levels. In the United States, growth is expected to slow down somewhat. We forecast that Chinese economic growth will continue to decelerate slightly and that the recession will ease up somewhat in Russia and Brazil. Global chemical production is likely to grow by 3.4% in 2016, slower than 2015 (+3.6%). The global economy continues to face increasing risks. For 2016, we assume an average price of $40 per barrel for Brent blend crude oil and an exchange rate of $1.10 per euro.

Trends in the global economy in 2016

- Stable growth expected for the European Union

- Economic cooldown in China with dampening effects on Asia’s emerging markets

- Recovery of Japanese economy unlikely

- Continued, but milder, deceleration predicted for South America

For 2016, we anticipate growth in the European Union’s economy on approximately the same level as the previous year. Low oil prices, largely stable prices, reduced interest rates and favorable euro exchange rates will support this development, although these factors do not represent additional growth stimulus as they have already been in effect since 2015. The economy will stabilize noticeably in southern Europe. In northwestern Europe and the eastern European E.U. countries, growth will hover at prior-year levels. We expect the recession to continue in Russia and Ukraine, although the decline is likely to ease off compared with 2015.

Growth in the United States will probably slacken somewhat in the face of slower industrial growth. Benefiting from the positive job market situation and low inflation rates, private consumption will provide some stability. Experience shows that rising real estate value also has a positive effect on consumption. Increasingly better production capacity utilization along with continuing low interest rates are likely to support the propensity to invest.

In the emerging markets of Asia, we assume that growth will weaken to a moderate level overall. Gross domestic product growth will continue to slow in China. The government’s monetary and fiscal easing measures could bolster the real estate market and automotive sector, but the growth stimulus will remain modest. China’s economic cooldown will continue to negatively impact trading partners in the region. Currently, the greatest risk for the global economy would be posed by growth in China that proves even weaker than our expectations.

Japan’s gross domestic product is expected to continue growing only minimally in 2016. Despite the weak yen, the current global economic environment gives no cause to believe that exports will significantly increase. Domestic demand may also grow only modestly. The sales tax increase expected for the spring of 2017 could, however, stimulate private consumption to grow faster than usual toward the end of 2016.

For South America, we expect a continued, if somewhat weaker, decline in gross domestic product overall. Structural reforms in Argentina should revive the economy in the medium term; in the short term, however, they will weaken private demand. We therefore anticipate a slight decrease in gross domestic product. Leading indicators do not yet point to an upswing in Brazil. We nevertheless do not expect the downward trend to continue unabated, especially since the sharp depreciation of the Brazilian real will support the export business.