Economic environment

The global economy grew only moderately in 2016 but was subject to regional fluctuations. While growth in the emerging markets remained almost unchanged in comparison with 2015, it decelerated in the industrialized countries due to the U.S. economy’s initially weak dynamic. In the European Union, growth in gross domestic product was just marginally below the previous year’s level despite the heightened uncertainty before and after the British referendum on leaving the E.U. Gross domestic product in China grew only slightly more slowly thanks to governmental economic measures. Overall, global gross domestic product grew by 2.3%, as we had anticipated, remaining behind the level of 2015 (+2.7%). The average price for a barrel of Brent blend crude oil fell to $44 per barrel (2015: $52 per barrel).

2.3%

Growth in global gross domestic product

1.9%

Growth in global industrial production

3.4%

Growth in global chemical industry

Trends in the global economy in 2016

The global economic environment was marked in 2016 by expansive monetary policy, low raw materials prices that nevertheless stabilized over the course of the year, and a modest growth dynamic. The especially low price of oil during the first half of the year dampened growth in the oil-producing countries and reduced the propensity to invest there, including the United States. Small levels of inflation, historically low interest rates and a weak euro supported growth in Europe.

The currencies of many emerging economies that export raw materials were weaker than in the previous year, but appreciated considerably over the course of 2016. This was due in part to a gradual rise in oil and precious metal prices in addition to the U.S. Federal Reserve’s cautious interest rate policy. Economic uncertainty increased considerably as the year progressed, largely as an effect of the British vote to exit the E.U., but also because of continuing geopolitical conflicts and unpredictability before and after the U.S. presidential elections.

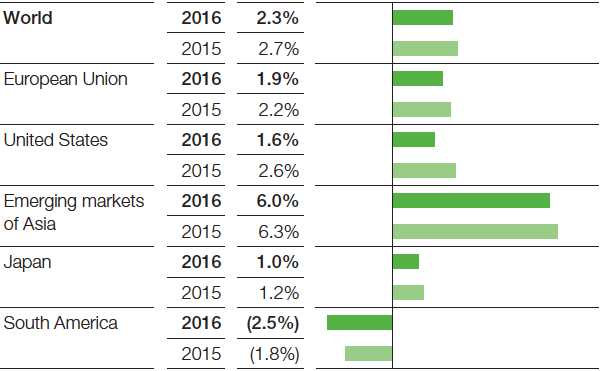

Gross domestic product

(Real change compared with previous year1)

1 Figures that refer to previous years may deviate from last year’s report due to statistical revisions.

Economic trends by region

- Economic growth somewhat slower in the E.U.

- Weaker growth in the U.S.

- Slowdown in China lighter than expected; stable growth in emerging markets of Asia

- Further decline of GDP in South America

In 2016, growth in the European Union’s gross domestic product slowed slightly, from 2.2% in 2015 to 1.9%. Development in the region continued to be marked by widely divergent trends in 2016: In northwestern Europe, growth rates remained at a solid level overall. In the United Kingdom, the increase in gross domestic product slackened only marginally after the referendum on a British exit from the E.U. Germany’s economic growth was at a comparatively robust 1.8% while that of France was more moderate, at 1.1%. In southwestern Europe, Spain continued its dynamic pace (+3.2%). By contrast, Italy (+1.0%) and Portugal (+1.4%) were not able to boost their economies to such a considerable extent. The central and eastern E.U. countries also boasted above-average growth (+2.8%), helped along by low inflation rates, ongoing low unemployment levels and the stable development of exports. In Russia, the economy shrank only slightly (–0.2%) after the previous year’s sharp decline (–2.8%), partly thanks to the stabilization in oil prices over the course of the year.

Growth in the United States during the first two quarters was considerably below the average for the year. Reasons included weak investment activity in the oil industry and cyclical inventory effects. Private consumption bolstered the economy. In the second half of the year, growth picked up thanks to increased investment and positive development in agricultural exports. Overall, the U.S. economy grew by only 1.6% in 2016 (2015: +2.6%), remaining behind its medium-term pace of around 2%.

Economic output in the emerging markets of Asia saw a somewhat slower increase as compared with the previous year (2016: +6.0%, 2015: +6.3%). This was largely attributable to the only slightly slower growth in China (2016: +6.7%; 2015: +6.9%). The construction and automotive industries benefited from government investments as well as impetus provided by monetary and fiscal policy. In this environment, the neighboring Asian countries grew at a relatively stable rate; India once again saw rapid expansion, at 6.8% (2015: +7.9%).

At 1.0%, growth remained modest in Japan. The appreciation of the yen against the U.S. dollar (around 10% compared with the previous year) and lower demand from China reduced both the year’s average exports and private companies’ propensity to invest. Lower imports, weakly growing private consumption, expanding housing investment and public expenditures compensated for these negative effects, so that the Japanese economy’s overall growth was about as strong as in the previous year.

Gross domestic product shrank once again in South America, by 2.5% (2015: –1.8%). Economic performance in Brazil remained 3.4% behind the previous year (2015: –3.8%). Gross domestic product declined in Argentina, as well, shrinking by 2.3% against the backdrop of high inflation and fiscal consolidation measures (2015: +2.6%). Venezuela and Ecuador suffered from the low price of crude oil; gross domestic product declined in both countries. The other countries in the region grew moderately on average.