Income from operations

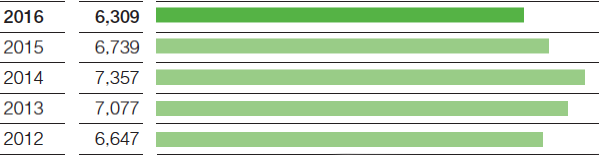

- EBIT before special items 6% below 2015 level, at €6,309 million

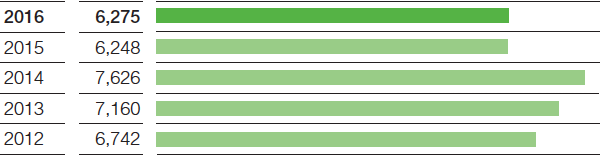

- At €6,275 million, EBIT matches prior-year level

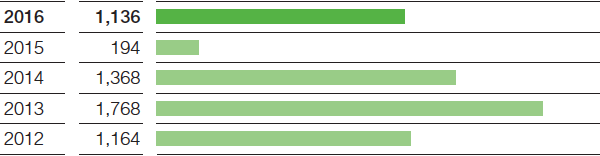

- EBIT after cost of capital rises considerably

At €6,309 million, income from operations (EBIT) before special items was €430 million below the level of the previous year. This was largely a consequence of the considerable decline in the Oil & Gas segment resulting mainly from falling prices and the divestiture of the natural gas trading and storage business. The activities transferred to Gazprom had contributed around €260 million to EBIT before special items in 2015. In the Agricultural Solutions segment, EBIT before special items matched the previous year’s level. We achieved a considerable increase in the chemicals business thanks to sharply improved contributions from the Performance Products and Functional Materials & Solutions segments.

Special items in EBIT amounted to minus €34 million in 2016, compared with minus €491 million in the previous year.

This development was mainly due to the special items recognized in other charges and income, which amounted to minus €44 million in 2016. In the previous year, other charges and income totaled minus €729 million, mostly comprising impairments on assets in the Oil & Gas segment.

Special charges from various restructuring measures came out to minus €394 million compared with minus €223 million in the previous year.

Divestitures in 2016 resulted in an earnings contribution of €431 million, after €476 million in the previous year, especially from the sale of the industrial coatings business and the polyolefin catalysts business in the Functional Materials & Solutions segment.

Integration costs for acquired businesses amounted to €27 million, compared with €15 million in 2015.

Special items (million €) |

|||

|

|

2016 |

2015 |

|---|---|---|---|

Restructuring measures |

|

(394) |

(223) |

Integration costs |

|

(27) |

(15) |

Divestitures |

|

431 |

476 |

Other charges and income |

|

(44) |

(729) |

Total special items in EBIT |

|

(34) |

(491) |

Special items reported in financial result |

|

– |

23 |

Total special items in income before taxes and minority interests |

|

(34) |

(468) |

At €6,275 million, EBIT for the BASF Group in 2016 matched the level of the previous year (2015: €6,248 million). Included in this figure is income from companies accounted for using the equity method, which rose from €251 million to €307 million.

We once again earned a premium on our cost of capital in 2016. EBIT after cost of capital amounted to €1,136 million compared with €194 million in the previous year. The cost of capital fell by €809 million year-on-year. In addition to the reduction of the cost of capital percentage by one percentage point, this was primarily the result of the lower level of tied-up capital in inventories and operating receivables.

The calculation of EBIT as part of our income statement is shown in the Consolidated Financial Statements

EBIT after cost of capital (million €) |

|||||

|

|

2016 |

2015 |

||

|---|---|---|---|---|---|

|

|||||

EBIT of BASF Group |

|

6,275 |

6,248 |

||

– EBIT of Other |

|

(1,091) |

(985) |

||

– Cost of capital1 |

|

6,230 |

7,039 |

||

EBIT after cost of capital |

|

1,136 |

194 |

||