Regional results

|

Regions (million €) |

||||||||||||

|

|

|

Sales |

Sales |

Income from operations | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|

2016 |

2015 |

Change in % |

2016 |

2015 |

Change in % |

2016 |

2015 |

Change in % | ||

|

||||||||||||

|

Europe |

|

27,221 |

38,675 |

(30) |

26,039 |

36,897 |

(29) |

3,632 |

4,174 |

(13) |

||

|

Thereof Germany |

|

17,540 |

28,229 |

(38) |

7,412 |

13,483 |

(45) |

1,582 |

2,303 |

(31) |

||

|

North America |

|

14,682 |

15,665 |

(6) |

14,042 |

15,390 |

(9) |

1,113 |

1,295 |

(14) |

||

|

Asia Pacific |

|

11,512 |

11,712 |

(2) |

12,165 |

12,334 |

(1) |

1,098 |

445 |

147 |

||

|

South America, Africa, Middle East |

|

4,135 |

4,397 |

(6) |

5,304 |

5,828 |

(9) |

432 |

334 |

29 |

||

|

|

|

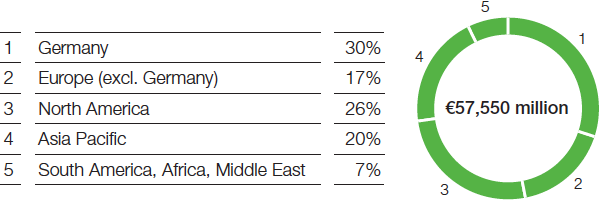

57,550 |

70,449 |

(18) |

57,550 |

70,449 |

(18) |

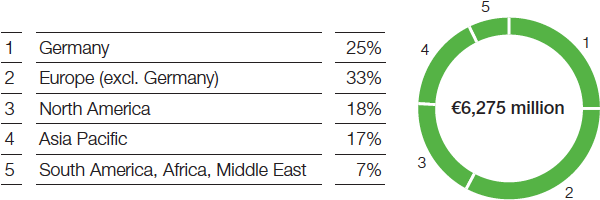

6,275 |

6,248 |

0 |

||

Europe

- At €27,221 million, sales down by 30% compared with previous year

- Additional investments initiated at Ludwigshafen Verbund site

In 2016, sales at companies headquartered in the region Europe amounted to €27,221 million, 30% below the previous year’s level. This was mainly attributable to the considerable decline in sales in the Oil & Gas segment following the disposal of our gas trading and storage business to Gazprom in September 2015.

Despite strong volumes growth, the Chemicals segment posted a considerable drop in sales due to lower sales prices brought about by decreased raw material prices. Sales in the Performance Products segment declined slightly, largely on account of lower prices and the disposal of portions of our pharmaceutical ingredients and services business. In the Functional Materials & Solutions segment, significantly higher volumes were able to more than compensate for price declines, resulting in a sales increase. Despite increased sales prices, a combination of lower volumes and negative currency effects resulted in a considerable drop in sales in the Agricultural Solutions segment. Sales declined considerably in Other.

Income from operations (EBIT) fell by 13% year-on-year to €3,632 million, primarily owing to the decrease in the Oil & Gas segment. Contributions were also smaller from the Chemicals and Agricultural Solutions segments, as well as from Other. The Performance Products and Functional Materials & Solutions segments, however, raised their EBIT.

We are strengthening our market position through further investments at the Ludwigshafen Verbund site, such as the replacement of our acetylene plant with a state-of-the-art, highly efficient production facility, and the expansion of capacities for resins.

North America

- Sales down 6% from the previous year to €14,682 million

- Ongoing investments in production plants, such as for ammonia and herbicides

Sales at companies headquartered in North America were down by 6% compared with 2015 in both euro and local currency terms, amounting to €14,682 million. This was largely due to decreased sales prices brought about by lower raw material prices, especially in the Chemicals segment. Sales volumes remained stable overall. Rising volumes in the Functional Materials & Solutions segment were able to offset the lower volumes in the Chemicals and Performance Products segments.

EBIT fell 14% to €1,113 million compared with the previous year. Significantly increased contributions from the Performance Products and Functional Materials & Solutions segments were only partially able to compensate for the sales and margin-related earnings decline in the Chemicals segment.

In this region, we continue to focus on innovation, attractive market segments and cross-business initiatives in order to grow profitably. At the same time, we are increasing our operational excellence through continuous improvement. Investments in new production facilities form the basis for future growth. For example, we are building a new ammonia plant in Freeport, Texas, with Yara; expanding production capacities for our dicamba and dimethenamid-P herbicides in Beaumont, Texas; and modifying the plant in Pasadena, Texas, to produce our Palatinol® DOTP plasticizer so we can meet growing demand in North America. Beyond that, we aim to gradually expand the production capacity of MDI at our Geismar, Louisiana, Verbund site.

Asia Pacific

- Sales 2% below 2015 level at €11,512 million

- Local production expanded through new plants in China and Malaysia

At €11,512 million, sales at companies headquartered in the Asia Pacific region fell by 2% in 2016; in local currency terms, sales matched the level of the previous year.

Low oil and raw material prices weighed on sales, especially at the beginning of the year. While sales prices did substantially recover over the year, they still showed an overall decline for 2016. Sales were also dampened by negative currency effects and portfolio measures such as the sale of the textile chemicals business in June 2015, parts of our pharmaceutical ingredients and services business in September 2015, and the polyolefin catalysts business in July 2016. Sales in Other decreased considerably. Volumes growth of around 5% in this region was only partially able to offset these effects. We raised sales volumes in all segments.

EBIT in the region grew by 147% to €1,098 million. This was mainly due to higher volumes and margins in all segments. Through strict cost management, fixed costs rose only slightly compared with the previous year, despite the startup of several new plants.

As part of our regional strategy, we want to further increase the proportion of sales from local production in Asia Pacific in the years ahead. We once again made progress toward this goal: In Korla, China, we started up a polytetrahydrofuran (PolyTHF®) plant with our partner Markor, and in Shanghai, China, we completed the modification of the polyvinylpyrrolidone

plant. In Kuantan, Malaysia, we and our partner PETRONAS started up a production plant for 2-ethylhexanoic acid and finished construction of the new aroma chemicals complex. Further endeavors, such as catalyst production plants in Caojing, China, and Rayong, Thailand, are currently under construction and progressing on schedule.

South America, Africa, Middle East

- Sales down 6% to €4,135 million

- Production plant for 2-ethylhexyl acrylate now in operation in Guaratinguetá, Brazil

At €4,135 million, sales for companies headquartered in South America, Africa, Middle East fell 6% below the level of 2015. In local currency terms, sales were up by 2%.

Gross domestic product shrank in South America primarily as a consequence of the continuing recession in Brazil as well as the economic environment and structural reforms in Argentina. Our sales declined slightly under these conditions. Price increases enabled us to partly offset negative currency effects, especially from the depreciation of the Argentinian peso, and weaker sales volumes. Sales declined in the chemicals1 and crop protection businesses but rose in the Oil & Gas segment.

Companies in Africa and in the Middle East posted a considerable sales decrease owing to currency effects and downward pressure on prices. The drop in sales in South Africa was primarily due to the depreciation of the rand; this particularly affected the Functional Materials & Solutions segment. In the Middle East, a slump in selling prices affected by falling raw material prices negatively impacted our business in the Performance Products and Functional Materials & Solutions segments.

EBIT grew by 29% to €432 million, supported especially by the higher contribution from the chemicals business.

In South America in 2016, we continued implementing a series of structural measures that increase our productivity and sharpen the focus on our customers’ needs. We have expanded our production in Guaratinguetá, Brazil, with the startup of a 2-ethylhexyl acrylate plant that will allow us to tap into the region’s growing demand.

1 Our chemicals business comprises the Chemicals, Performance Products and Functional Materials & Solutions segments.