Business expansion in emerging markets

In the years ahead, we want to grow even more vigorously in the emerging markets and further expand our position there. Today’s emerging markets are expected to account for around 60% of global chemical production in 2020. We aim to benefit from the above-average growth in these regions and therefore plan to invest more than a quarter of our capital expenditures1 there between 2017 and 2021.

Growth in the emerging markets remained overall stable in 2016 as compared with the previous year. In China, government support measures kept growth from slowing down as much as we had expected. The other emerging markets of Asia were able to largely retain their growth dynamic. Gross domestic product continued to drop in South America. Brazil found itself in a severe recession, while gross domestic product decreased slightly in Argentina, as well. Economic performance in Russia shrank only marginally after sharp declines in the previous year; a contributing factor was the stabilization of oil prices. Overall, the emerging markets of eastern Europe were able to post slight growth once again.

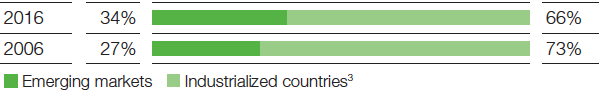

Compared with 2015, sales (excluding Oil & Gas) at our companies headquartered in the emerging markets declined by 3% to €14,849 million. Increased sales volumes could only partly compensate for negative currency and price effects. Measured by customer location, sales (excluding Oil & Gas) in the emerging markets fell by 4% to €18,742 million. This brought sales to customers in emerging markets to around 34% of total sales (excluding Oil & Gas) in 2016. In the years ahead, we want to continue expanding this percentage.

1 Excluding additions to property, plant and equipment resulting from acquisitions, capitalized exploration, restoration obligations and IT investments