Outlook for the chemical industry

- Global growth in chemical industry at level of previous year

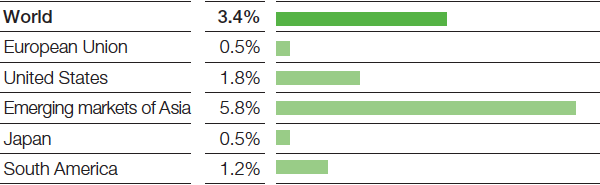

Global chemical production (excluding pharmaceuticals) will probably grow by 3.4% in 2017, the same pace as 2016 (+3.4%). We anticipate a marginally higher expansion rate in the advanced economies (2016: +0.9%, 2017: +1.1%). Growth in the emerging markets will presumably weaken somewhat (2016: +5.4%, 2017: +5.1%). The global growth rate of the chemical market will be largely determined by developments in China, which accounts for more than a third of worldwide production. There, the upward trend may continue to slacken but producers in China are nevertheless likely to contribute more than two percentage points to worldwide chemical industry growth. Yet macroeconomic risks in China remain high, therefore, our forecast for global chemical growth is marked by particular uncertainty.

Chemical production in the European Union is expected to barely grow faster than in 2016. In general, the increase in production will remain modest against the backdrop of a sluggish domestic market. We expect competitive pressure on export markets to remain intense, even though the naphtha-based European chemical industry benefits more from low oil prices than the gas-based production in the United States.

In the United States, we expect somewhat faster growth in chemical production, at just under 2%, as new production capacity, which will also be used for export, comes onstream.

Overall chemical growth is likely to decelerate somewhat in the emerging markets of Asia, mainly due to the slowdown in China, which will affect the other developing countries in the region.

In Japan, we presume a weak overall economic environment and minimal growth in chemical production.

In South America, the anticipated end of the recession in Argentina and Brazil will result in slight growth in chemical production in the region.