BASF share performance

- BASF share gains 24.9% in 2016

- Long-term development continues to clearly outperform benchmark indexes

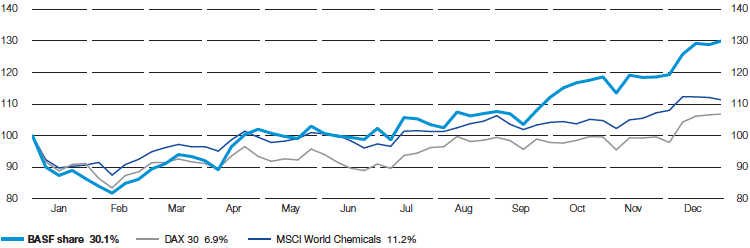

Weak economic data from the United States and China as well as turbulence in the crude oil market led to a negative start to the 2016 stock market year. Gains in oil prices, solid U.S. labor market data and better economic indicators for China led to stock market recovery during the second quarter. The uncertainty leading up to the United Kingdom’s referendum on E.U. membership influenced the further course of the second quarter. Stock markets suffered considerable losses following the vote on June 23, 2016, to leave the E.U. Share prices subsequently recovered thanks to factors such as improved Chinese economic data and the U.S. Federal Reserve’s initially unchanged interest rate policy. In the fourth quarter, the extension of the European Central Bank’s bond-buying program as well as hopes for a growth-promoting economic policy from the newly elected U.S. president led to a year-end rally. On December 30, 2016, Germany’s benchmark index, the DAX 30, reached a year’s high of 11,481 points, as did the BASF share price at €88.31. This equates to a 24.9% rise in the value of BASF shares compared with the previous year’s closing price. Assuming that dividends were reinvested, BASF shares gained 30.1% in value in 2016. The BASF share thus outperformed the German and European stock markets, whose benchmark indexes DAX 30 and DJ EURO STOXX 50 gained 6.9% and 3.7% over the same period, respectively. As for the global industry indexes, DJ Chemicals increased 10.8% in 2016 and MSCI World Chemicals 11.2%.

Change in value of an investment in BASF shares in 2016

(With dividends reinvested; indexed)

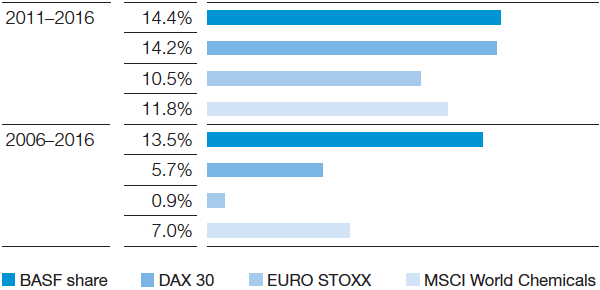

Viewed over a five and ten-year period, the long-term performance of BASF shares still clearly surpasses these indexes. The assets of an investor who invested €1,000 in BASF shares at the end of 2006 and reinvested the dividends in additional BASF shares would have increased to €3,538 by the end of 2016. This represents an annual yield of 13.5%, placing BASF shares above the returns for the DAX 30 (5.7%), EURO STOXX 50 (0.9%) and MSCI World Chemicals (7.0%) indexes.

Long-term performance of BASF shares compared with indexes

(Average annual increase with dividends reinvested)

Weighting of BASF shares in important indexes as of December 31, 2016 |

||

DAX 30 |

|

8.7% |

|---|---|---|

DJ Chemicals |

|

6.5% |

MSCI World Index |

|

0.3% |

Further information on BASF share |

||

Securities code numbers |

|

|

|---|---|---|

Germany |

|

BASF11 |

Great Britain |

|

0083142 |

Switzerland |

|

11450563 |

United States (CUSIP Number) |

|

055262505 |

ISIN International Securities Identification Number |

|

DE000BASF111 |

|

|

|

International ticker symbol |

|

|

Deutsche Börse |

|

BAS |

London Stock Exchange |

|

BFA |

Swiss Exchange |

|

BAS |