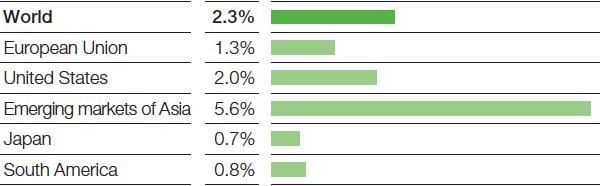

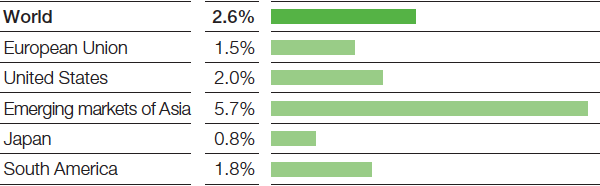

Economic environment in 2017

The global economy will presumably grow by 2.3% in 2017, about as fast as in 2016 (+2.3%). In light of significant political uncertainty, volatility is likely to remain high. We forecast a considerable slowdown in growth in the European Union. For the United States, we currently anticipate a slight upturn in growth. Growth in China is likely to continue its downward trend. We expect the recession in Brazil and Russia to end. We assume that global chemical production will grow by 3.4% in 2017, comparable with the rate of 2016. For 2017, we predict an average price of $55 per barrel for Brent blend crude oil and an exchange rate of $1.05 per euro.

Trends in the global economy in 2017

- Weaker growth likely in the European Union

- Further slowing of growth expected for China

- Slight upturn probable in the United States

- End of recession anticipated for Russia and Brazil

Economic growth in the European Union is expected to slow down considerably in 2017. In the United Kingdom, uncertainty as to the terms of exit from the European Union is likely to curb investment and private consumption. This weaker dynamic will have a dampening effect on the growth of Britain’s E.U. trading partners, including Germany, Italy, France and Spain. Growth will presumably remain at a stable higher level in the eastern E.U. countries. We expect the recession in Russia to end, supported by our forecast of a slight recovery in the oil price.

Following the administration change in the United States, economic prospects for the United States are especially difficult to predict. We assume that this uncertainty will be reflected in a greater reluctance to invest in the manufacturing and service sectors. Nevertheless, overall economic growth in 2017 will quicken somewhat, as investments in the oil and gas industry are unlikely to continue declining. While the tax cuts planned by the new U.S. administration could have positive effects on growth, the expected protectionist measures and the stronger U.S. dollar pose risks to the country’s economy.

In the emerging markets of Asia, we expect growth to continue weakening in 2017. Against the backdrop of economic restructuring in China, we anticipate a further cooldown in economic momentum. We predict growth at levels comparable to 2016 for the other countries in the region. While developments in China will probably exercise a dampening effect, raw material prices and demand for imports from South America and Russia should stabilize. The region’s economy is supported by a solidly growing IT and communications industry.

Japan’s gross domestic product is expected to maintain its merely minimal upward trend in 2017. Monetary and fiscal policy will continue to provide some growth impetus; however,

investment momentum and private consumption will remain on the slow side in an environment of weak domestic demand. Moreover, we do not expect any significant impulses that would boost exports.

We anticipate an end to the economic downturn in South America. Leading indicators suggest that Brazil has bottomed out. Falling interest rates and declining inflation could increasingly support readiness to invest in the country; export demand is also likely to rise. We forecast economic recovery in Argentina. Decreasing inflation, a stable exchange rate and a better investment climate should provide impetus for growth.